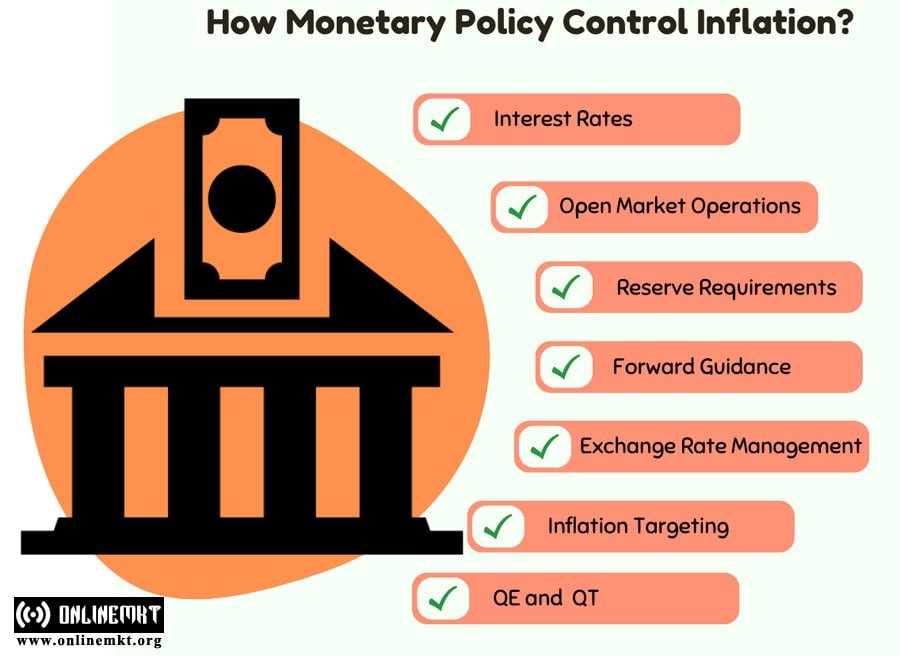

How Monetary Policy Control Inflation?

Worried about rising prices? Learn how monetary policy can help stabilize the economy and protect your purchasing power.

Rising inflation has become a significant concern for people worldwide as the cost of living keeps increasing. But did you know that central banks have a powerful tool to control runaway prices? This tool is called monetary policy, and it is their main method of influencing inflation rates.

You might have heard terms like “interest rates” and “money supply” in discussions about inflation, but do you understand how central banks use these tools to stabilize prices? In this post, we will explore the inner workings of monetary policy and break down the specific mechanisms central banks use to manage inflation.

Interest Rates

Raising interest rates makes borrowing more expensive, which slows down spending and investment. This decrease in demand helps stabilize prices and control inflation. On the other hand, lowering interest rates makes borrowing cheaper, stimulating the economy and potentially increasing inflation.

Open Market Operations

When inflation is high, central banks sell government securities to reduce the money supply and curb demand. When inflation is low, they buy securities to inject more money and stimulate the economy. By carefully adjusting the money supply, central banks can manage inflation and maintain price stability.

Reserve Requirements

When central banks increase reserve requirements, commercial banks must hold more deposits as reserves, reducing the money available for lending. This shrinks the money supply, making it harder for people and businesses to borrow, which slows economic activity and curbs inflation. Lowering reserve requirements has the opposite effect, allowing more lending and boosting the money supply, which can lead to higher inflation. By adjusting reserve requirements, central banks can effectively manage the money supply and inflation.

Forward Guidance

Central banks use forward guidance to influence inflation expectations and control inflation. By providing information about future monetary policy intentions, they shape the public’s expectations about future borrowing costs and inflation.

Forward guidance is especially useful when interest rates are low. By signaling the future path of policy, central banks can influence real interest rates and inflation expectations, guiding the economy toward their inflation target.

Quantitative Easing (QE) and Tightening (QT)

Quantitative Easing (QE) and Quantitative Tightening (QT) are essential tools central banks use to control inflation. During economic stagnation, QE injects money into the system by purchasing assets, lowering interest rates to encourage spending. However, excessive QE can overheat the economy. To counteract this, central banks use QT to sell assets, reducing the money supply and raising rates to cool inflation.

Exchange Rate Management

Carefully managing the exchange rate can enhance the effectiveness of inflation targeting. Freely floating exchange rates can lead to self-fulfilling expectations of higher inflation and currency depreciation. However, by managing the exchange rate, central banks can stabilize inflation expectations and prevent large swings from impacting consumer prices. This approach helps central banks maintain credibility and achieve their inflation targets.

Inflation Targeting

Inflation targeting offers a clear, transparent, and accountable framework for monetary policy. By setting a specific inflation target, the central bank communicates its objectives clearly to the public and holds itself accountable for achieving them. This approach anchors inflation expectations, facilitating the central bank’s ability to effectively control inflation. Over time, inflation targeting has demonstrated its effectiveness in helping central banks maintain price stability and support economic growth.

Conclusion

In conclusion, monetary policy plays a crucial role in controlling inflation. Through adjustments in interest rates, central banks can impact the cost of borrowing, consumer spending, and investment, thereby influencing overall price levels in the economy. While the mechanisms involved may appear intricate, the objective is straightforward: to uphold price stability and promote sustainable economic growth.