Future of Fintech

Forget everything you think you know about banking – the future of finance is here.

The digital revolution in financial services is just beginning-discover the groundbreaking innovations shaping the future of fintech.

It’s hard to pinpoint exactly how and where the shift in financial services began, but the 2008 global financial crisis was clearly a turning point, sparking the rise of the FinTech era (Anyfantaki, 2016).

Cevik (2024) paper has showed that fintech’s impact on real GDP per capita growth varies by instrument type. Digital lending, as a portion of GDP, has a significant positive effect. Digital capital raising has a large but insignificant effect. Overall, fintech has a positive and statistically significant impact because digital lending dominates.

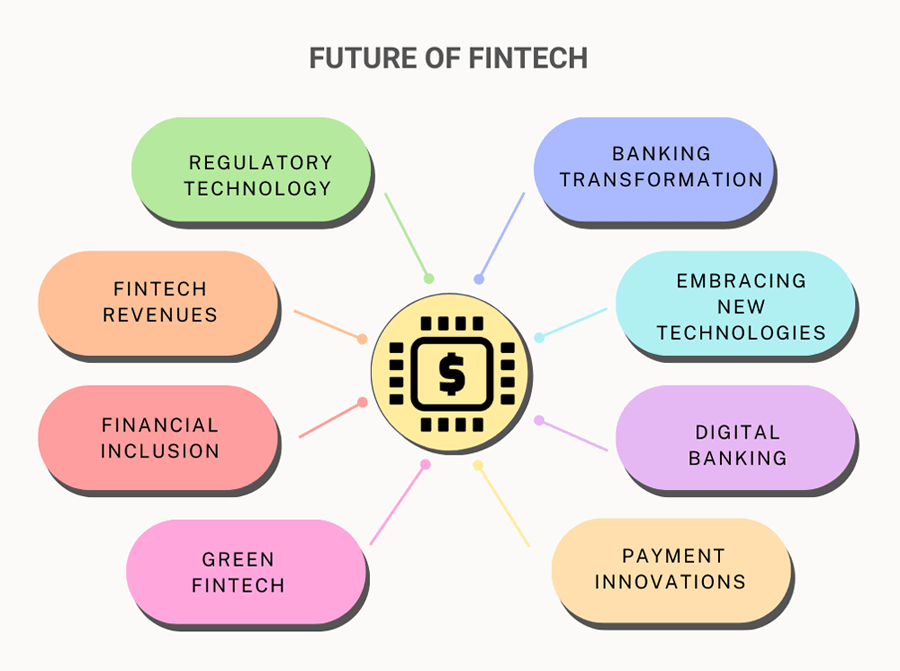

Key trends and developments that are likely to shape the future of fintech:

Banking Transformation

Fintechs are expected to continue reshaping banking services with innovative, customer-centric solutions. FinTechs solution help banks modernize operations, automate processes, and cut costs. Using technologies like AI and blockchain, banks can offer more efficient services and remove the need for manual tasks.

Murinde (et al., 2022) paper finding has shown that FinTech lenders probably will not fully replace banks. This is likely because banks are creating their own FinTech platforms or partnering with FinTech start-ups.

Use of Apps

Fintech will also integrate financial services into super apps, expand access in emerging markets, and leverage AI for tailored advice. Regulatory developments and blockchain technology will further shape app functionalities and services.

Embracing New Technologies

Emerging technologies like artificial intelligence (AI), blockchain, and cloud computing will continue to transform the fintech landscape. AI will be used for personalized financial advice, automated trading, and fraud detection. Blockchain could revolutionize areas like cross-border payments and identity management.

Digital Banking

Digital technologies automate many financial activities and offer new, cost-effective products in various parts of the financial sector, including lending, asset management, portfolio advice, and payment systems (Vives, 2017).

Payment Innovations

The payments landscape will see continued innovation, including faster, more secure, and more convenient payment methods. Contactless payments, mobile wallets, and real-time payments will become more dominant.

In the payments market, mobile wallets have high growth potential in the consumer-to-business segment. Mobile wallets are digital platforms that deliver a wide range of services, including both payment and non-payment services, to end users (Omarini, 2018).

Open Banking

Open banking initiatives will promote greater competition and innovation in the financial services sector. By allowing third-party developers to build applications and services around financial institutions, consumers will benefit from more diverse and tailored financial products.

Green Fintech

The FinTech industry drives sustainable economic growth and has positive social, environmental, and ecological impacts. It can support funding for energy and environmental projects and the construction of renewable energy and environmental infrastructure (Vergara & Agudo , 2021).

Financial Inclusion

FinTech will improve financial inclusion by offering financial services to underserved populations. Mobile banking, microfinance, and alternative credit scoring models will help close the gap.

Our findings lead to several conclusions. First, FinTech indirectly reduces income inequality by promoting financial inclusion. Second, financial inclusion reduces inequality across all levels, with a stronger impact at higher levels. Finally, financial inclusion significantly lowers inequality, especially in higher-income countries (Demir et al., 2022).

Fintech revenues

The global fintech industry saw a sharp rise in revenue from 2017 to 2023. In 2023, the industry earned an estimated 79.38 billion U.S. dollars. Statista Market Insights predicts that the global fintech sector’s revenue will continue to grow, surpassing 141.18 billion U.S. dollars by 2028 (Statista Research Department,2024).

In the banking sector, FinTech might reduce banks’ ability to generate revenue and harm their capital adequacy by causing a loss of deposits. Financial institutions increasingly depend on non-interest income (Anyfantaki, 2016).

Regulatory Technology (RegTech)

Financial systems are changing quickly, and regulators need to use more RegTech tools to keep up. Even though the main goals of regulation (like financial stability, prudential safety and soundness, consumer protection and market integrity, and market competition and development) haven’t changed, the old ways of doing things don’t work as well anymore. New RegTech tools are changing how we think about financial regulation altogether (Arner et al., 2016).

References:

- Anyfantaki, S. (2016). The evolution of financial technology (Fintech).

- Arner, D. W., Barberis, J., & Buckey, R. P. (2016). FinTech, RegTech, and the reconceptualization of financial regulation. Nw. J. Int’l L. & Bus., 37, 371.

- Cevik, S. (2024). Is Schumpeter Right? Fintech and Economic Growth.

- Chueca Vergara, C., & Ferruz Agudo, L. (2021). Fintech and sustainability: do they affect each other?. Sustainability, 13(13), 7012.

- Demir, A., Pesqué-Cela, V., Altunbas, Y., & Murinde, V. (2022). Fintech, financial inclusion and income inequality: a quantile regression approach. The European Journal of Finance, 28(1), 86-107.

- Murinde, V., Rizopoulos, E., & Zachariadis, M. (2022). The impact of the FinTech revolution on the future of banking: Opportunities and risks. International review of financial analysis, 81, 102103.

- Omarini, A. E. (2018). Fintech and the future of the payment landscape: The mobile wallet ecosystem. A challenge for retail banks?. International Journal of Financial Research, 9(4), 97-116.

- Statista Research Department, ” Revenue of fintech industry worldwide from 2017 to 2023, with forecasts from 2024 to 2028″, statista, Feb 22, 2024. https://www.statista.com/statistics/1384016/estimated-revenue-of-global-fintech/

- Vives, X. (2017). The impact of FinTech on banking. European Economy, (2), 97-105.