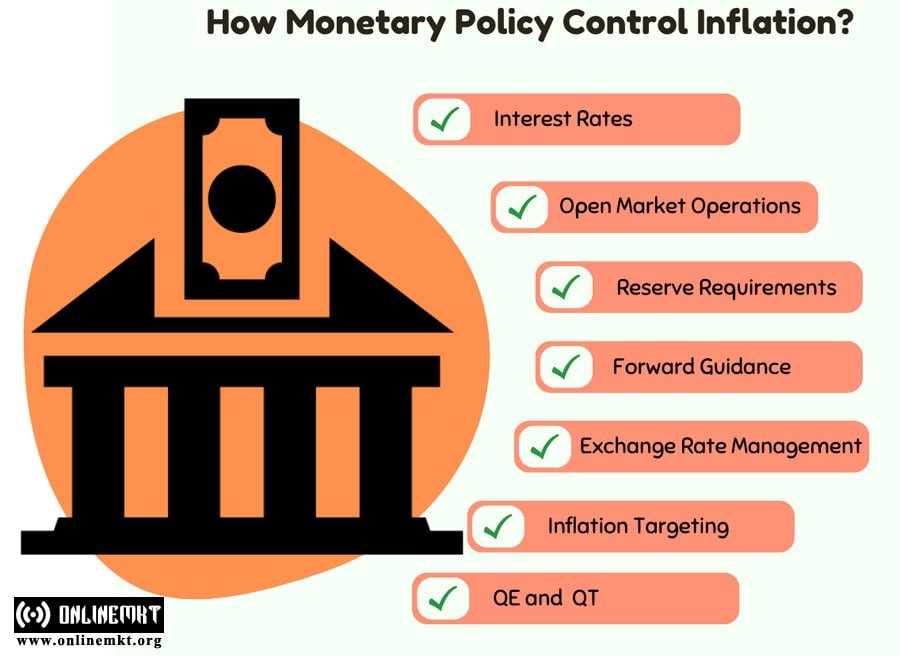

How Monetary Policy Control Inflation?

Worried about rising prices? Learn how monetary policy can help to stabilize the economy and protect your purchasing power.

The raising rate of inflation is one of the major problems people are facing on their daily life. However, do you know that central banks have a powerful tool to stabilize prices? It is monetary policy-the primary means through which central banks influence inflation.

In cases like this, you may come across words like “interest rates” and “money supply” thrown into conversations on inflation but do you really know how central banks do it? Here, we are going to shed some light on the phenomenon of monetary policy as well as look into how particular mechanisms are carried out by central banks for managing inflation.

Interest Rates

The interest hikes tend to increase the price of borrowing, thus reducing spending and investment. Ultimately, this decreases demand, which stabilizes prices and controls inflation. In contrast, low-interest rates make borrowing cheaper, stimulating the economy and ultimately bring more inflation.

Open Market Operations

When inflation is above average, central banks tend to sell government securities with the aim of reducing the money supply and curbing demand. When the inflation rate is lower, then the central banks buy securities to inject more money into the economy to stimulate it. By careful signaling of the money supply, central banks are able to manage inflation so that prices are stable.

Reserve Requirements

When reserves are increased by the central banks, the commercial banks must hold more reserves for every deposit, consequently lowering the amount of money available for lending. With this tight restriction of the money supply, it becomes hard for people and companies to borrow, thereby damping economic activity and inflation as well. Lowering reserve requirements opens greater avenues for lending into the economy, thus increasing the money multiplier and inflating the economy. With reserve adjustments, central banks can cut back or expand the money supply at will.

Forward Guidance

Forward guidance is a monetary policy tool for changing inflation expectations and monitoring the inflation rates. By revealing the intended course of future monetary policy, forward guidance makes known what is anticipated as the future public expectation on borrowing and inflation costs.

Forward guidance is also more appropriate when actual interest rates are low. The central government signals to influence real interest as well as inflation expectations through its future policy path.

Quantitative Easing (QE) and Tightening (QT)

QE and QT are used by central banks to control inflation. It purchases assets, with injections of money into the economy to reduce interest rates, encouraging spending during economic stagnation. But QE in excess could put the economy at risk. Hence, it also sells off assets to reduce the money supply to cool off inflation.

Exchange Rate Management

The effective management of the exchange rate could enhance inflation targeting. Open floating exchange rates could lead to expectations of higher inflation which in turn could convince consumers they are going to run out of money before their next paycheck. However, banks stabilize this process through proper management of their exchange rates with the aim of stabilizing inflation expectations and therefore would not make large swings in consumer prices. This way, it enhances the credibility of the bank to achieve its inflation targets.

Inflation Targeting

Inflation Targeting offers clear and accountability framework for monetary policy. When a central bank chooses a specific inflation rate to attain as a target figure, it has publicly announced its objective and made itself accountable for reaching such a figure. It inspires to anchor inflation expectations, allowing the central bank an easier way to control inflation. Over time, inflation targeting has shown effectiveness in maintaining price stability while growing an economy.

Conclusion

In short, the role of monetary policy in controlling inflation is very important. Central banks can affect the price level in the entire economy by means of the price at which they lend money to banks or through adjustments in interest rates. The whole mechanism in these becomes quite complicated, but the essence remains simple to understand: stabilize the prices, and create sustainable growth.