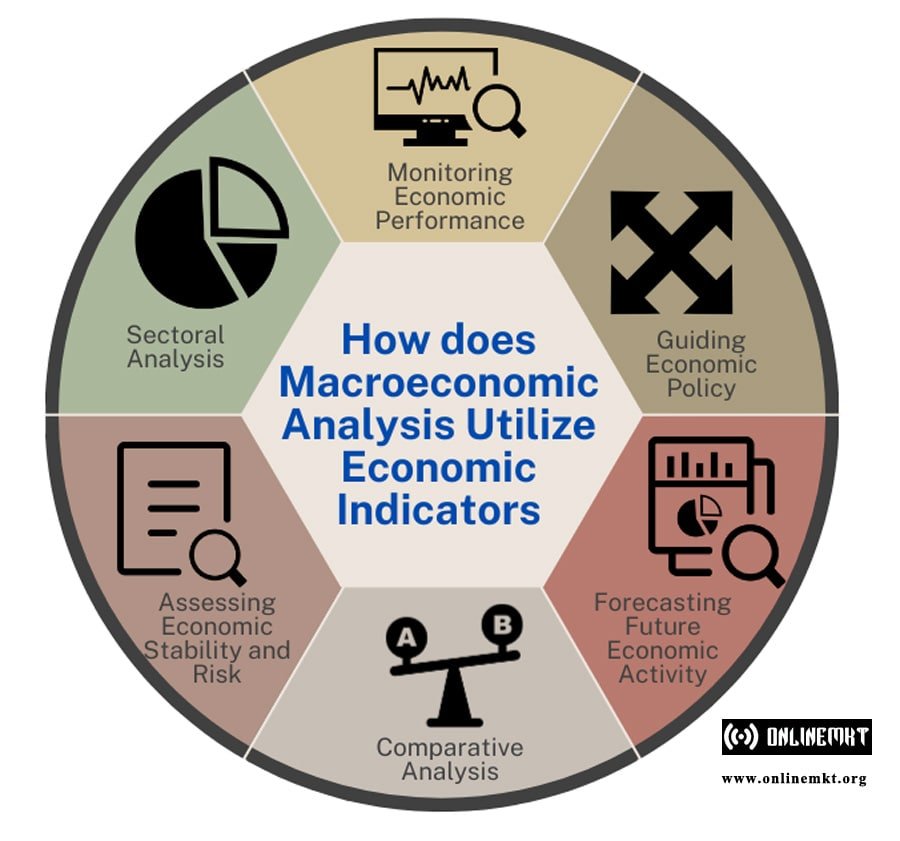

How does Macroeconomic Analysis Utilize Economic Indicators?

From predicting recessions to guiding policy decisions, discover how economic indicators play a crucial role in shaping our world.

Macroeconomists use various economic indicators to uncover the economy’s true stage. They consider various measures instead of relying on a single clue to measure economy status. GDP, unemployment, inflation act as fingerprints to measure whether the economy is thriving, struggling, or status-quo terms.

Governments and central banks act as judges and juries in the economy by the application of these indicators. They judge the patterns and trends of GDP, unemployment, and consumer prices to have a view of the economy. If things are not going well, they can adjust interest rates and government spending or take other economic decisions to stabilize the economy.

Here is a detailed explanation of how macroeconomic analysis utilizes economic indicators:

Monitoring Economic Performance

Gross Domestic Product (GDP)

The Gross Domestic Product (GDP) is a measure for analyzing the economic health and performance of a country. Ideally, by measuring changes in GDP over a period of time, economists and policymakers can assess the direction of the economy and make right decisions on policies.

GDP data also reveals the nature of economic activity. Through the study of consumption, business investment and other components, significant movements and trends can be teased out and compared, ultimately revealing new opportunities and risks.

Unemployment Rate

An unemployment rate can measure the percentage of people within the labor force that cannot find a job. A high unemployment rate therefore indicates inefficiency; missing potential outputs and growth. Conversely, a low rate suggests that the economy operates at full capacity, whereby any person wishing to work finds themselves employed.

The unemployment rate is economic indicator that governments and policymakers rely on to frame any economic policy. High rates of unemployment during a recession can result in job stimulus policies. On the contrary, keeping unemployment low or heading down lower during a period of expansion may require tackling both inflation and the overheating aspect of an economy.

Inflation Rate

Inflation is one of the most important indicators of an economy’s health. Macro economists closely study the inflation as it reflects what is happening with the price level. When there is high or even unstable inflation, it indicates that there may be underlying problems in the economy. If inflation is followed closely by the accurate predictability of varied inflation effects, then it could be a signal to policymakers on the success to stabilize economy.

In addition, the rate of inflation helps transforming nominal economic variables into real terms and allows macroeconomists to assess real changes in output, purchasing power or living standards. This will provide a much clearer picture of the workings of the economy beyond nominal fluctuation because of inflation.

Guiding Economic Policy

Interest Rates

Interest rates are usually taken as the most dominant macroeconomic indicator and the most important policy tool. As part of monetary policy, central banks adjust interest rates to influence the economy.

When the economy is sluggish, central banks reduce interest rates so as to increase borrowing, investment, and consumer spending to boost growth and employment. Lower interest rates consequently unfreeze demand; high interest rates, on the other hand, make borrowing costlier, thus reducing demand tied with the recession of the economy. Macroeconomic analysis keep a close eye on variations of interest rates and how they affect GDP, unemployment, and other macroeconomic variables and present analyses useful for policymakers in the economy.

Fiscal Policy Indicators

Fiscal Policy is an essential tool for macroeconomic analysis in guiding the economy. Policymakers can shape aggregate demand, employment, inflation, and economic growth by adjusting government expenditure and taxation.

Expansionary fiscal policies, for example, tax cuts or increasing government expenditures tend to stimulate the economy during periods of economic decline. Conversely, higher taxes and less government spending are effective in erasing an economy’s overheating and curtailing inflation. Fiscal policy along with the monetary policy of central banks work collectively for the growth and stabilization of economy.

Forecasting Future Economic Activity

Generally, macroeconomic analysis is about forecasting possible future economic activities by monitoring certain key indicators. Some of the indices that economists closely monitor are GDP growth, unemployment rates, inflation, consumer spending, and industrial production, which they use to identify and forecast trends in economic.

For instance, these forecasts would provide realistic information for policymakers, businessman, and consumers. Based on this information, government officials formulating fiscal and monetary policies, industries analyzing their production and investment strategies, and consumers make rational and sound financial decisions.

Comparative Analysis

Macroeconomic analysis is very valuable when it comes to comparative studies. By looking at the indicators such as GDP, unemployment, and inflation, analysts can compare the economies’ relative performance.

The performance of country can be compared in terms of economic growth, labor markets, and price stability with other countries. Comparative analysis allows for the internal evaluation of the relative economic development of country and also serves as a bench mark for cross-national or temporal comparisons in formulating policy decisions.

Assessing Economic Stability and Risk

Proper macroeconomic analysis can keep an economy stable and manage risks in that economy. By monitoring primary indicators such as GDP growth, inflation, and unemployment, policymakers can recognize the likely downturn in the economy and take precautionary actions.

According to such an assessment, risks to financial stability arise because of the difference between expectations of economic growth in the future and downside risks to future growth in GDP, popularly called “GDP at risk.” Thus, efforts can be made to equalize actions on stabilizing the macro economy and addressing vulnerabilities in their financial system.

Sectoral Analysis

Macroeconomic analysis is essential for understanding sectoral economy impact as it provides true economic picture of different sectors. National output, unemployment rates, and inflation help analysts to figure out tendencies that shape the performance of a sector. For instance, during boom economic, finance and consumer discretionary are some of the sectors that normally prosper due to higher borrowings and expenditure. On the contrary, defensive sectors, such as utilities, normally perform better during the downturn.

Macroeconomic analysis can also be profitably used in making sectoral investment decisions. For example, investors can use this to have some understanding of interest rates and employment levels, thus predicting the sectors that might be booming under such prevailing conditions. This insight allows one to adopt a more strategic, targeted investment strategy.

Conclusion

Macroeconomic analysis is indispensable in understanding the broader world trends and patterns that go hand in hand with our financial life. Continually observing and interpreting economic indicators enables policymakers, businesses, and individuals to make rational decisions that have the potential to impact the economy positively.