Estate Planning Basics

Essentially, estate planning is making rational choices regarding one’s estate, which includes cash, real estate, investments, and personal possessions. The main objective is to ensure that one’s assets are distributed according to one’s desire and managed accordingly when the owner is incapable of doing so.

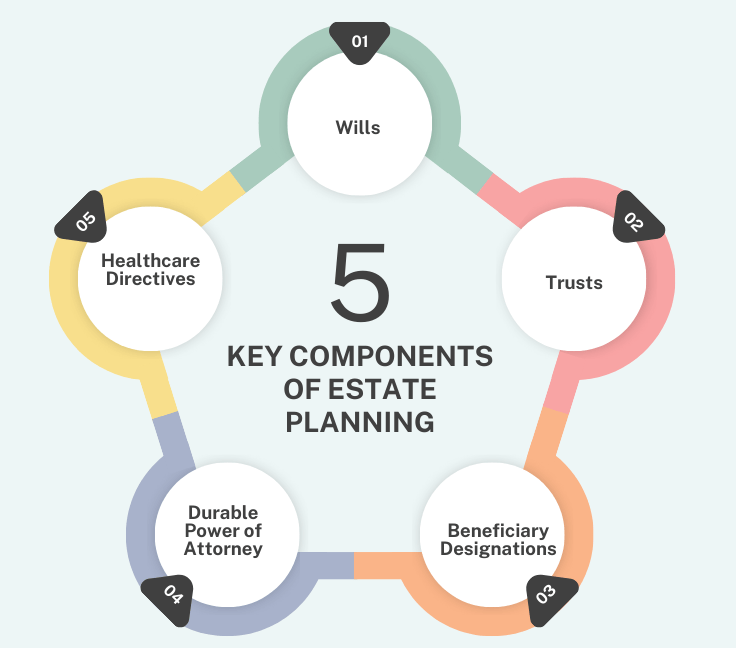

Key Components of Estate Planning

Wills

Will is a legal document that acts as a foundation under which all your assets will be distributed after your death. It names an executor who is responsible for administering your estate and seeing that your wishes are executed. In case you die without a will, state laws come in, distributing your estate under a predefined formula which may not necessarily be what you had wished for. For instance, if there were no will, then perhaps part of your estate ends up being passed onto some distant family member with whom you’re not even on speaking terms.

Trusts

Trusts allow for flexible asset management while alive and beyond. They also help to avoid the lengthy legal procedures by which an estate is distributed after death, called probate. Different type of trusts such as revocable and irrevocable for controlling assets. While you are alive, a revocable trust gives you control over your assets, and it will show how the assets will be managed or distributed after one dies.

Beneficiary Designations

To some accounts, such as those involving life insurance policies and retirement plans, beneficiary designations become important. Such designations will have greater priority than your will; hence, it is very essential that you keep them updated. Doing so will make sure that when the time comes, the assets will go to the people you want to receive them. It would be pretty difficult, though, if you still have an ex-spouse, one who remains to be the beneficiary of the property, because the designation was never updated, and you find this condition – well, it might change what you had in mind regarding the estate distribution.

Durable Power of Attorney

A durable power of attorney is a valid binding document that lets you empower any chosen trusted individual to make financial decisions on your behalf in the event of your incapacitation. Such a provision ensures that a trusted person can manage your affairs without going through the probate courts, which gives you peace of mind knowing that your financial affairs get handled responsibly.

Healthcare Directives

Also called living wills, healthcare directives specify the type of medical treatment you would like to receive and appoint someone to make medical decisions when you cannot communicate such wishes. This document is vital regarding your medical treatment preferences when you may be unable to express them due to an accident, illness, or other unforeseen circumstance.

Why is Estate Planning Important?

Estate planning is something that all people must consider. It should be brought into everyone’s life for peace of mind that ensure your wishes are carried out. It is necessary to create estate plans because the absence of an estate plan mean that your assets will be distributed as per state laws that sometimes do not fulfill your desires. Besides, a well-developed estate plan can keep down taxes and avoid longer probate procedures of estate so that much estate is hand over to your heirs.

Common Misconceptions

There is a misconception that estate planning only for the old and the very rich. In fact, everyone at and above the age of 18, who is old enough to know how to use a legal pen, should start planning an estate. Life is unpredictable so it does not matter if one is young and wealthy or old and rich having estate plan ensures their wishes are taken care. Setting up a plan provides a scope for those below to know and respect their wishes. As an example, young parents may wish to appoint a guardian for their children in the case of an untimely death, which is something they need to mention in their estate planning, but most people do not give it a second thought.

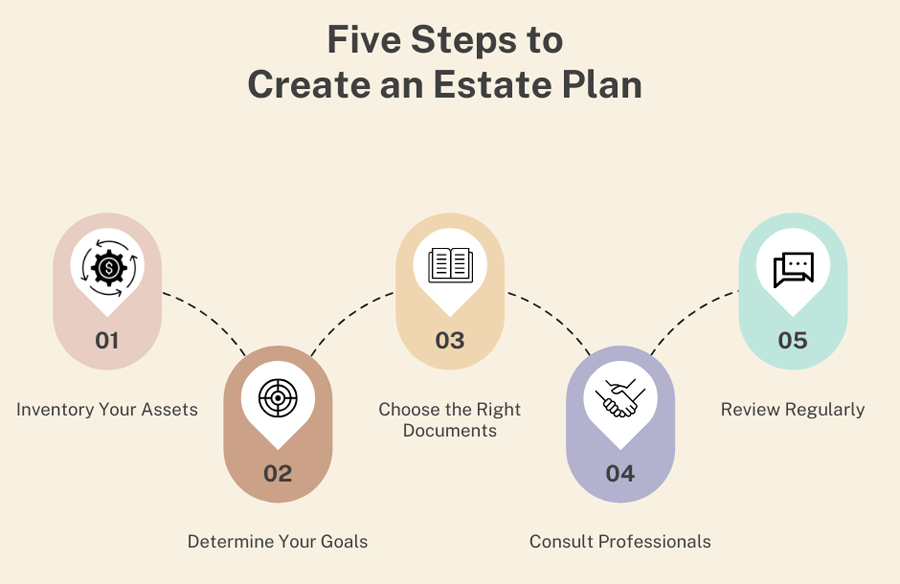

Steps to Create an Estate Plan

Inventory Your Assets

First, it is necessary to put together a complete inventory of all the assets and their estimated values, which includes real estate, as well as bank accounts, investments, and personal property. A good understanding of one’s estate is essential for effective planning because it ensures that nothing is overlooked.

Determine Your Goals

Consider what goals you want to achieve with your estate planning, which may include whom you want to leave your estate to; who will take charge of your affairs if you are unable to do so due to sickness, incapacitation etc., what specific requests regarding your health will need to be incorporated into your estate planning; and what kinds of things will make sure those requests are carried out.

Choose the Right Documents

Next, identify the legal documents needed based on the objectives you determined. Possible examples would be a will as well as a trust, power of attorney, and healthcare directive, each one is responsible for implementing your wishes.

Consult Professionals

There are online resources for DIY estate planning; however, you should consult an estate planning attorney or financial advisor, especially with cases that are even complicated assets or family affairs to ensure that your plan works legally and addresses your needs well. A professional advice is really helpful when one faces unique situations and complicated family matter.

Review Regularly

This is not something that should only be done once- it is possible that over the years different life events occur, such as marriage, divorce, and birth, and that may require one to change their estate plan. The only way to ascertain this is to sit down regularly to review and update documents.

Conclusion

Creating an estate plan is important for everyone, without any consideration to age or wealth. Spending time putting together a good estate plan will allow you to ensure that your wishes are respected, that your loved ones are safeguarded, and that your legacy is preserved. It facilitates navigation through the details of asset distribution and management, offering peace of mind and security for those you care about.