What Cause Cryptocurrency Market Crash

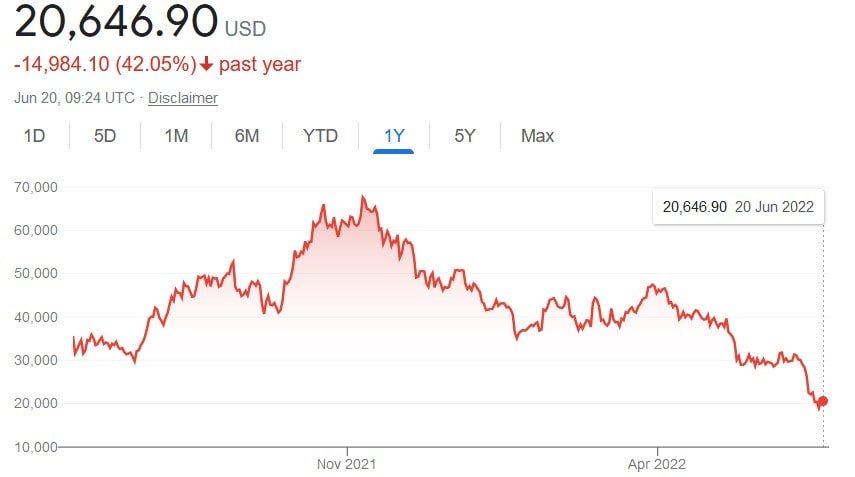

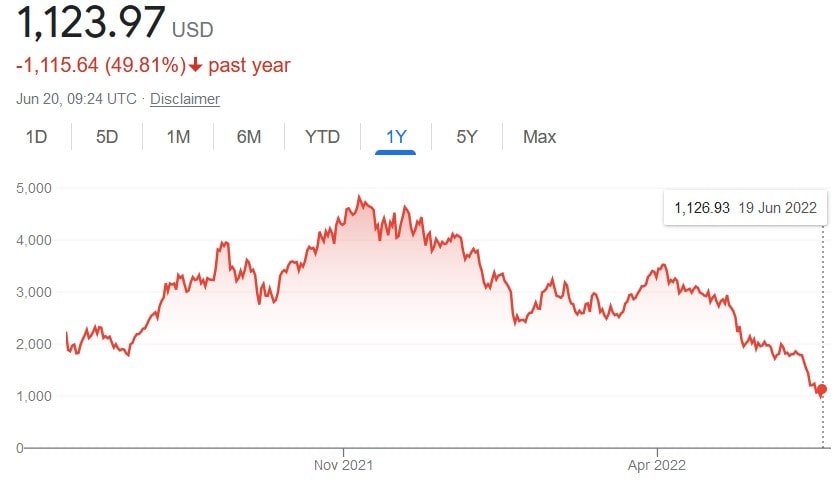

After hitting the all-time high $3 trillion mark in November 2021, the global cryptocurrency market capital has fallen by more than $2 trillion and was worth $821.72 billion on June 19, 2022. Almost all of the world’s most valuable digital currencies are now worth half or even less than their all-time highs price.

Continuously downfall in price may not be stressful to early investors. However, the current cryptocurrency market crash has been particularly painful for investors who bought cryptocurrencies while prices were sky-high last year.

Price is totally determined by the demand and supply of digital currency in the market. Positive sentiments among investors increase the demand for currency and ultimately increase the price of currency whereas negative sentiments lead to the downfall in price. Now, the reason is clear, there are more negative sentiments in the market for investors.

Crypto experts believe that the ongoing conflict between Russia and Ukraine that causes inflation hitting a new 40-year high is a reason for the stock and crypto markets’ price declines.

China’s continuing crackdown on cryptocurrency is also a factor. There have also been rumors in the market that Russia may stop to accept crypto as a payment method.

No one can predict how long the crypto-crisis will last and will rebound after hitting the lowest bottom. It may take a few months to several years to reach new highs.

Let’s have a look at a few major reasons for the Cryptocurrency Market Crash

Equity Market

Bitcoin Price Falldown

There is a positive correlation between the equity market and the crypto market. If we see a downfall in the stock market, the same we can witness in the crypto market. Most of the factors affecting the stock market also affect the crypto market.

Evaluating all market indicators, it seems the cryptocurrency markets are maturing – like other financial markets, crypto has a bear and bull phase, and we are currently in a bearish phase.

Interest Rate

The Fed would pursue an aggressive strategy to raise debt prices, limit expenditure, and contain record-high inflation. Consumers will be discouraged from making major purchases so that there will be less demand for goods and services in the market This initiative will help to reduce prices by reducing customer demand and stabilizing prices in the economy.

However, the aggressive increase in interest rates is viewed as a leading recession indicator. So, investors prefer not to invest in both the stock market and the crypto market.

Celsius

Withdrawals and transfers at Celsius (a major US cryptocurrency lending company), have been halted due to “extreme” conditions. When a leading platform does something like this, investors get concerned that others may follow in their footsteps, creating a market crash, and they hurry to sell their coins before the market collapses.

Regulatory Challenges

The charm of cryptocurrencies is their decentralized system, without a central issuing or regulating authority. The global crypto industry has been scrutinized by governments throughout the world as they attempt to regulate cryptos. As a result, investors lose faith in cryptocurrency since the government may determine its price by manipulating demand and supply.

Risky Asset

Ethereum Price Falldown

Risk assets are investments that have a high level of volatility in the normal course of business operation. cryptocurrencies —are risk investments since their prices are subject to frequent ups and downs in nearly any market environment.

Bitcoin is considered a non-risky asset for holding momentary value until a few months back from now. That isn’t the case now. Today, all major economic conditions and news have an impact on its price. So, it becomes less important for investors for investing that causing a fall in the price of cryptocurrencies.

Diversifying Portfolio

As economic condition around the world is not so good. Many investors prefer to invest in less risky, more stable assets, such as US Treasury bonds.

Some bitcoin investors are considering other investment options, such as shifting their money back to the dollar, and other powerful currencies as a starting point, and then deciding what to do from there to protect themselves from heavy financial loss.

Conclusion

You must act wisely whether you decide to sell your cryptocurrencies or consider this downfall as an opportunity to buy more. Making emotional decisions, particularly while trading, rarely yields any positive results.

Examine how the underlying position for crypto might change as a result of recent developments: Will governments become harsher in their approach? Will they inspire more people to use it? Will new rules benefit the cryptocurrency business rather than damage it? What other factors could influence the market? Before jumping into the crypto market.