Understanding Investor Psychology

The stock market is not just a battle of numbers; it is a psychological war.

The understanding of investor psychology is necessary because it helps to figure out how investment decisions are taken. It is all about the emotional and cognitive aspects that influence investors’ behavioral differences when it comes to investing in the financial market. One could eliminate irrational decision-making when they observe the psychological components that affect behaviors relating to investment and further improve the investment results.

Major Concepts in Investor Psychology

Emotional Influences

An emotion is one of the strongest motivators in investing. More of the time, it results in an emotional rather than a factual decision-making. Fear and greed and Loss aversion are the two most significant types of emotions that inspire action.

Fear and Greed

Fear and greed are like the two edges of a coin. Fear attracts panic in investors and then causes them to sell off investments in downturns and losses. Greed is the influence behind buying at unreasonable prices because the general market is soaring. Like fear, acts as an emotional driver and results in buying during the market’s highest points and selling at its lowest.

In the financial crisis of 2008, fear for many investors turned into selling their stocks for pennies on the dollar, resulting in massive losses. On the other hand, during the late 1990s, the dot-com bubble, greed made all investors to pick tech stocks for investment without a second thought to the risks. This resulted in some great losses when the bubble finally burst.

Loss Aversion

It is well known that loss aversion is a psychological trait that makes most of the people avoid losses than value gains. Thus, such kind of psychological stress can make the investments too awkward and often keep investors away from being risky even when there are really valuable rewards. This can cause confusion with respect to opportunities in the market.

Rather than selling and reallocating funds to a potentially better investment, an investor may cling to a poorly performing stock, hoping for a recover in its price. The pain of holding onto a stock in loss outweighs the expected gain from reallocation to a different strategy.

Cognitive Biases

Cognitive biases are mental shortcuts which may end in wrong choices and decisions. Such biases interfere with investors’ capacity to objectively think. Major cognitive biases are:

Confirmation Bias

This bias makes investors to accept information that supports already held beliefs and rejecting opposite thoughts. Such one-sided thinking would not result in the right investment decisions based on partial evidence. For example, an investor believing only one tech company will finally make it within that industry, cause them to highlight only positive news and negates warning flags. Hence, the investment strategy becomes imbalanced.

Overconfidence Bias

Overconfidence in investment is dangerous because every investment has certain degree of risk. Overconfident investors generally fail to assess clearly their own knowledge and skill levels. They get into heavy trading or take high-stake risks, leading them to heavy losses.

A day trader believes that market forecasts can be predicted at a high accuracy level. Thus, he trades more frequently most of the time, incurring high transaction costs, thereby losing expected profits.

Anchoring Bias

Anchoring occurs where investors keep focusing on a piece of information such as a stock past performance and allow this piece of information to guide their decision making. This can distort the perception of what the stock is likely to provide in the future. When a stock was previously at $100 but is now at $50, the investor can be made to anchor to the previous high and expect the stock to return to that level instead of seeing that circumstances have changed.

Behavioral Finance

Behavioral Finance merges traditional financial theories with psychology-centered insights. It assumes that investors do not necessarily behave rationally and biases and emotions dictate their actions. By understanding these psychological tendencies, investors can come up with methods to avoid common pitfalls and to arrive at more rational decisions.

For instance, the behavioral finance theory might explain why a number of investors still stick to a losing stock and expect that in time it will recover, even when almost every indicator suggests that it is bound to go down further. Understanding this would also empower the investors to cut losses early on and make decisions in a more informed manner.

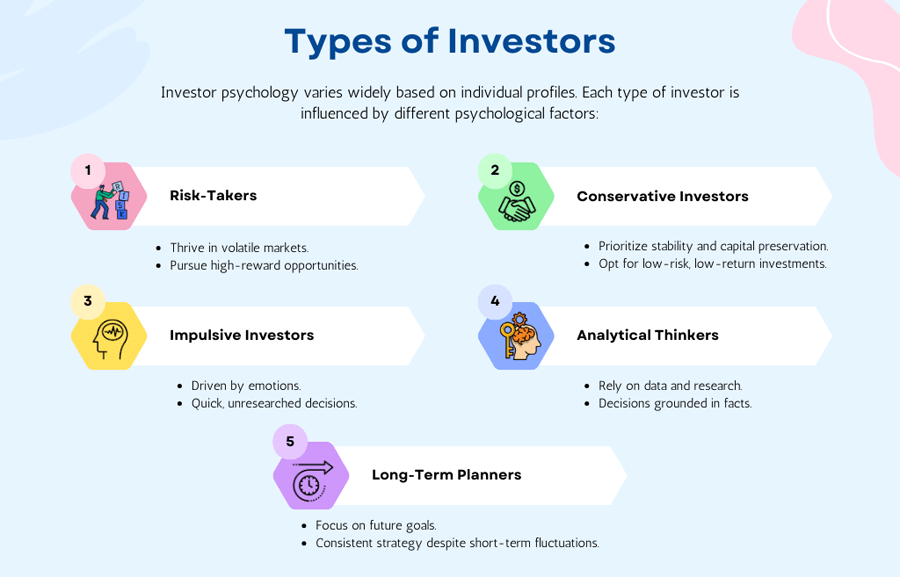

Types of Investors

Investor psychology varies widely based on individual profiles. Each type of investor is influenced by different psychological factors:

Risk-Takers

Risk-taker investors typically invest in potentially high-reward, sometimes speculative, investment opportunities. They feel energized because of the possibility of a mega windfall, but this does not mean they are free to take chances whenever they like without proper scenario analysis.

Conservative Investors

Conservative investors prefer to keep their money in low-return but safe investments. Stability and capital protection usually come first to them. While this risk-averse mentality can shield them during downturns, it may sometimes prevent good return of investment on growing market.

Impulsive Investors

Irrespective of emotions, impulsive investors will always act per their impulse and draw rash conclusions without reviewing and analyzing everything completely. Such an attitude leads to high inconsistent investment patterns and huge losses in investment.

Analytical Thinkers

These investors draw insights from data and research, using facts but no emotion when making decisions. While very effective, this strategy requires discipline in analyzing the results even when emotions fly high.

Long-Term Planners

Long-term planners maintain their strategies regardless of whatever fluctuations occur in the market on a short-term basis, moving consistently toward their future goals. This level of discipline yields steady growth and resilience in the face of market volatility.

Strategies for Managing Investor Psychology

Navigating the complexities of investor psychology requires deliberate strategies:

Education

The first step in addressing and overcoming cognitive biases and emotional triggers is to become aware of their existence. Understanding these psychological factors would help you to find when an irrational thought would affect a decision.

Diversification

Investing in different types of assets would help to mitigate the risks attached to emotional decisions based on a single investment. It would diversify a portfolio to withstand changing market conditions. For example, an investor who invests widely in stocks, bonds, and real estate will most likely be less vulnerable to an economic downturn in any one market.

Professional Guidance

It is essential to have professional guidance to control your emotions during financial crisis. Their experience would serve as a buffer against such kind of impulsive decision-making.

Self-Reflection

On a regular basis, investors should assess their investment decisions against the emotions that force them to take investment decisions. Self-reflection would lead to a greater self-awareness and perhaps help you become more disciplined and thoughtful in investment strategies.

Conclusion

Thus, psychology of the investor is important when it comes to successful investment. The investors would be able to pinpoint different emotional and cognitive influences in decision-making and work out a strategy that may counter the effects of these influences and enable them to make informed decisions. Such knowledge helps in personal investment strategies as well as whole system stabilization within the financial market. The application of psychic ideas in investment strategy can bring about resilience and increase the possibility of success over a long period.