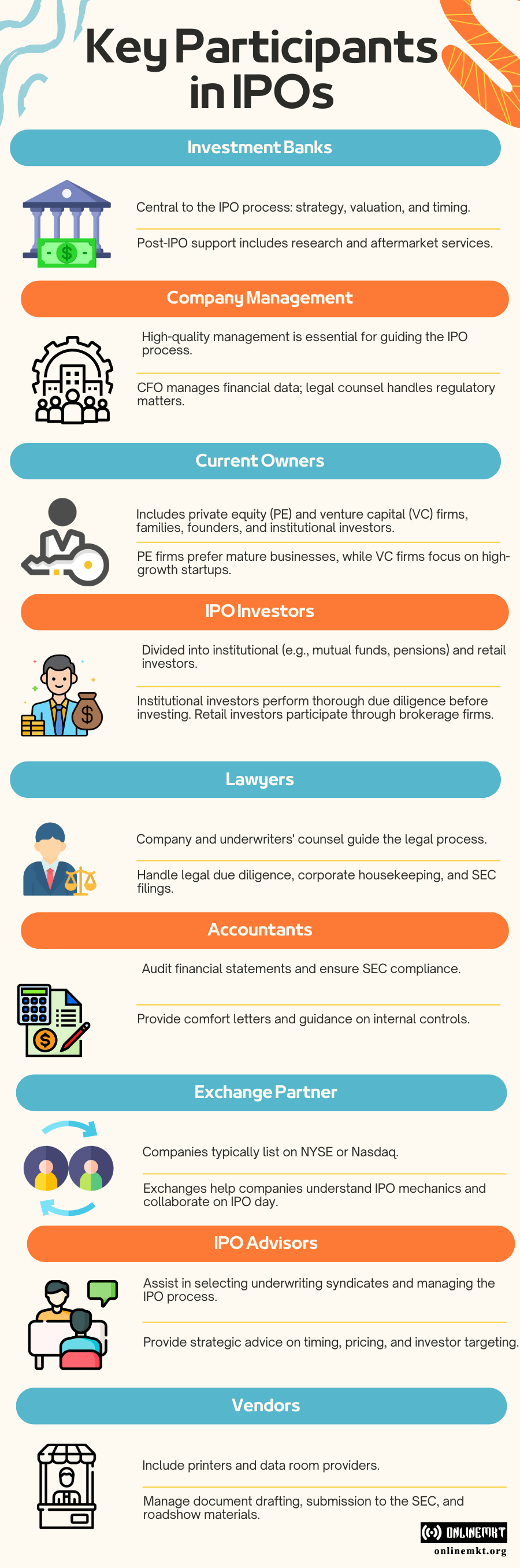

Key Participants in IPOs

A private company selling its shares to the public to raise funds from investors is known as an initial public offering or IPO. This is the process of changing a private company into a publicly-traded firm.

Investment Banks

The IPO process is dominated by investment banks. They play a central role in the IPO process, starting with the idea generation phase and continuing through the intensive preparation phase to the IPO execution and pricing of the stock.

Once the lawyers and lead banks are chosen, this entire process can take several months. After the IPO, investment banks provide crucial aftermarket support and research to the company.

Investment banks are required to determine whether a company is a suitable candidate for an IPO before they begin the formal process. They may actively seek out companies that they feel are suitable for IPO months or even years ahead of time. They may also advise companies on how to position themselves for eventual IPOs.

Because they are responsible for building a stock order “book”, the lead banks are also known as book-runners. They have more to do than just selling stock. They act as advisors in all aspects of an IPO, including strategy, positioning, valuation, structuring, and timing.

Banks have assembled a multi-faceted team that includes sector experts, equity capital market professionals, traders, salespeople, research analysts, and brokers.

Company Management

It is crucial that the company has a high-quality management team to guide it through the grueling IPO process. From the preparation phase to marketing and execution, the team’s abilities and resolve are tested. They collaborate closely with lawyers, accountants, bankers, and bankers to ensure that the IPO documentation is of the highest quality.

The CEO is responsible for the delivery of the above. However, the “deal captain” coordinates both internally and externally the day-to-day deliverables. This person could be a COO, General Counsel, or Head of Corporate Development.

Senior executives need to balance their IPO responsibilities and their core jobs. Investors won’t be kind to the company if it allows the IPO process to distract from its financial performance.

The financial statements and other financial data required to present the prospectus and roadshow are the responsibility of the CFO and the broader finance team. Corporate strategy and the business development team ensure that competitive opportunities and internal growth initiatives are adequately captured.

Depending on the company’s needs, Sales & Marketing might also be involved in the drafting of key IPO materials. The company’s legal counsel collaborates closely with the outside counsel regarding the prospectus, SEC matters, and due diligence as well as other regulatory approvals.

Management is the face of the company on the roadshow and the de facto chief marketer of the story. Before deciding whether or not to invest, investors will carefully listen to the management. They will ultimately ask: “Is this the team we want to support?”

Current Owners

In the context of an IPO, the company’s owner must also be considered. The typical owners are Private equity (PE) and venture capital (VC) companies, families, founders, management, and others. Some institutional investors, sovereign wealth funds, and pensions might also have substantial ownership stakes in pre IPO candidates. This is particularly true for high-profile, larger companies.

As we have discussed, PE firms are more likely to invest in mature, later-stage business models that have sufficient cash flows to support the high leverage. Larger firms may have large companies that an IPO exit would be a good option.

This could make it more attractive to monetize than an outright sale. However, VC firms tend to invest in smaller companies at the early stages that promise high growth. These companies are more speculation-oriented and technology-oriented. Many of these companies are innovators who have disruptive business models and no obvious buyers or clear public competition at the time they offer IPO in the market.

Many reasons family-owned businesses go public include legacy, generational change, monetization, and competitiveness. Depending on the situation, an IPO might prove to be more attractive than an outright sale. The IPO allows new shareholders to own the company, but the family can retain control by retaining outright majority ownership or privileged shares.

IPO Investors

IPO investors are the buyers of the company’s new equity shares, typically broken down into two main categories–institutional and retail. The largest group of investors, accounting for approximately 80% of the offering, are institutional investors.

These include mutual funds and hedge funds, sovereign wealth funds, pensions, insurance firms, and family offices. Individuals who purchase shares in an IPO through their brokerage company are called retail investors. These investors are often referred to as an individual or high-net-worth investors.

Before participating in an IPO, institutional investors must conduct thorough due diligence and undergo formal approval processes. Securities and Exchange Commission (SEC), guidelines require that all investors receive the preliminary prospectus of the issuer or “red herring”.

The prospectus provides essential information about the company and any investment opportunity. It is important to read before you invest.

However, a thorough review of the prospectus is only one part of institutional due diligence. Another important milestone is the roadshow meeting with management. This allows investors to hear directly from management and take part in a Q&A session.

These meetings usually include a slideshow presentation. They can be either one-on-one or part of a group meeting with investors. Often these meetings take place over breakfast or lunch.

Lawyers

From the beginning, legal counsel is involved in the IPO process. The selection of the leading investment banks is usually done in conjunction with the selection of lawyers. The two of them work together to guide the company through the process.

This can be complicated due to the SEC rules. There are two major groups of lawyers involved in an IPO: company counsel and underwriters’ counsel. They work together to finalize the legal agreements and ensure a successful outcome.

Company counsel makes sure that the company is legally prepared to go public. This includes conducting extensive legal due diligence and corporate housekeeping, which may include a review of the company’s current corporate structure, ownership arrangements, and material contracts.

The registration statement is also drafted by company counsel. This includes actively drafting the document with key bankers and company officers as well as filing the document. Company counsel manages the registration process and works with the SEC to answer any questions or comments.

Accountants

The company’s financial statements are reviewed and audited by the accounting firm for inclusion in the prospectus. This must be done in compliance with SEC rules, which generally require three years’ worth of audited historical financials and five years’ worth of selected financial data. Investors often consider a well-respected independent auditor to be their IPO partner.

After the initial audit of the company’s financial statements for inclusion in the registration declaration, the accounting firm assists the company with any follow-up questions from the SEC during its review period. The accounting firm also provides a comfort letter that confirms the accuracy of financial data in the registration statement.

The comfort letters are an important part of the due diligence conducted by the underwriters as well as their counsel. The accounting firm provides guidance on internal controls for the soon-to-be public company. This includes identifying and addressing any accounting problems going forward.

Exchange Partner

The company’s exchange is an important partner in the IPO process. Companies considering an IPO are more likely to start interacting with potential exchange partners before the process begins.

They work with companies to help them understand IPO mechanics. After being selected, they begin to work closely together, including collaboration on the company’s IPO day. This is a high-visibility milestone that will help you brand your company.

U.S. companies usually choose to list on the NYSE or Nasdaq. Electronic trading was invented by Nasdaq in 1971. Their model is still the norm for all markets around the world. Both the NYSE and Nasdaq have electronic markets.

NYSE employs a floor-based system in conjunction with designated market makers (third-party high-frequency trading firms), while Nasdaq uses its own proprietary technology, which was developed in partnership with investment banks.

Nasdaq Private Market is also available to private companies. This allows early investors, employees with vested equity, and private companies to facilitate secondary transactions while they are still private.

Companies must submit a listing application, a listing agreement, and a corporate governance certificate when applying to list on an American exchange. A listing application can take between four and six weeks. However, this time frame is flexible and can be reduced if there are no issues or the company responds quickly and to staff comments.

IPO Advisors

It is becoming more common to hire IPO advisors before embarking on a formal IPO procedure. They are responsible for coordinating a smooth and successful process and acting as advisors on all matters, from execution-related to strategy. They are independent of and in addition to the traditional investment bank underwriters, who oversee the IPO process.

The most important deliverable of IPO advisors is to help shareholders and the company selects the best underwriting syndicate. This includes identifying a few banks to be considered and then coordination of the outreach and bake-off process.

IPO advisors usually draft and distribute an RFP (request for proposals) to banks. They also schedule bake-off meetings. These advisors attend the presentations and help to grade banks on different metrics such as experience, unique knowledge, insights, research, distribution capabilities, and relationships with shareholders and the company.

After the bank leaves the lead, the IPO advisors negotiate the underwriter fees and take over the day-to-day management of the IPO process. The IPO advisors remain involved in advisory and monitoring roles, as well as participating in the registration statement drafting and due diligence sessions.

They also provide input on various topics. They are also responsible for organizing the outreach to critical research analysts and the subsequent diligence and engagement.

The IPO advisors offer advice to the lead bookrunners regarding timing, offering structure and size, as well as valuation. They have a wealth of experience working in a variety of sectors and situations, which helps them to formulate their opinions on the best execution. This is also true for their input on pricing, investor targeting, and allocation strategies.

Vendors

The IPO process is also aided by third-party service providers and vendors, such as the printer and data room providers. The printer types the registration statement and then submits it electronically via EDGAR to the SEC. Many glossy hard copies of the prospectus are printed and distributed to potential investors during the roadshow launch.

A shortlist of potential providers must be selected by the company, often with guidance from its lead bookrunner. Once the virtual data room has been set up, it is populated by a variety of documents related to the IPO. They are organized by category. This allows for underwriter due diligence as well as document drafting.