Inflation

Inflation is an increase in the general price level of goods and services in an economy over a period of time.

Price Goes Up Over Time. “Inflation occurs when the price of goods and services increases over time,” the Federal Reserve says. The Fed states that it can happen when demand exceeds supply (“demand-pull inflation”). Or, it may occur as a result of rising supply-side prices (“cost-push inflation”).

according to economists – A strong economy requires “price stability,”. That notion is flawed. Prices constantly increase and decrease in a normal economy.

Friedrich Hayek, an economist, is renowned for his explanation of how markets may allocate resources in a way that best satisfies society’s needs and desires.

For instance, it is normal for the cost of shoes to increase in response to actual consumer demand for a “hot” new style. The fact that the costs are growing tells manufacturers, retailers, and others that consumers are purchasing premium shoes.

Additionally, higher costs have additional benefits since they entice other shoe producers to the market with the promise of possible profits. Products that are even better and fresh begin to appear. More options are available to consumers. Due to increased market competition, those popular designs can actually become more affordable.

Similarly, discounters will start lowering prices if the sneakers don’t sell. Manufacturers will cease producing those sneakers and focus their efforts on creating ones that consumers would like. Therefore, rising and decreasing prices are essential for allowing markets to satisfy consumer demands and generate wealth.

Prices often increase during boom periods when demand is high and decrease during recessions when people are scrimping and saving. This is true even when a currency’s value is predictably steady. Prices often increase as countries grow richer.

For instance, prices in India are less expensive than in prosperous Singapore. Prices in India would probably increase to Singapore levels if the country were to become as prosperous as Singapore.

The natural rise in demand increased prices that the US and other countries experienced in the first few months of 2021. The COVID-19 pandemic-related year-long shutdown had produced unprecedented trauma for the world economy, which was only beginning to recover.

People were starting to return to their jobs, travel, dine out, and shop. Costs of labor were also increasing. People who lost their jobs were obtaining new positions and demanding greater compensation. Companies were competing for employees’ home time by offering emergency unemployment benefits.

Current Inflation

Inflation began again in 2021 and kept growing in the subsequent months. The United States’ annual inflation rate rose to 9.1 percent in June 2022. There is a high probability that inflation will continue for a few more times.

Even a return to the stagflation of the 1970s cannot be completely ruled out. The causes back then were the oil crises of 1973 and 1978. In contrast, there are a number of reasons for the outbreak of the 2020s inflation, including:

- COVID-19 and the accompanying expansion of the money supply,

- trade conflicts, particularly between the U.S. and China,

- disruptions in global supply chains,

- demographics leading to production and supply constraints,

- war in Ukraine

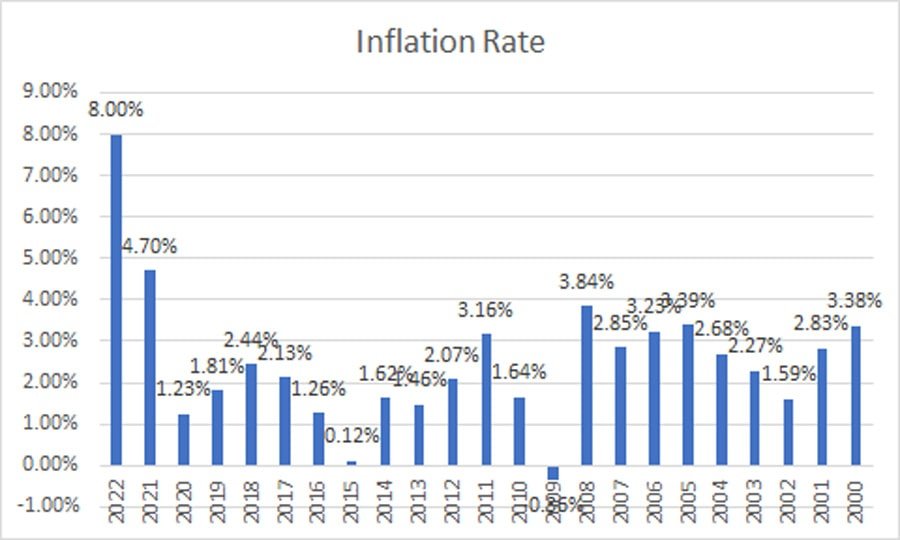

Inflation Year over Year

Year-over-year (YOY) inflation is the percentage change in the price level of a basket of goods and services from one year to the next. It is calculated by comparing the price level in a given year to the price level in the previous year and expressing the change as a percentage.

For example, if the inflation rate was 2% YOY, it means that the price level of a basket of goods and services in the current year is 2% higher than it was in the previous year.

YOY inflation is a useful measure of inflation because it helps to smooth out short-term fluctuations in the price level and gives a clearer picture of the underlying trend in prices. It is also a widely used measure of inflation by central banks and other economic organizations.

| Year | Inflation Rate (%) |

| 2022 | 8.00% |

| 2021 | 4.70% |

| 2020 | 1.23% |

| 2019 | 1.81% |

| 2018 | 2.44% |

| 2017 | 2.13% |

| 2016 | 1.26% |

| 2015 | 0.12% |

| 2014 | 1.62% |

| 2013 | 1.46% |

| 2012 | 2.07% |

| 2011 | 3.16% |

| 2010 | 1.64% |

| 2009 | -0.36% |

| 2008 | 3.84% |

| 2007 | 2.85% |

| 2006 | 3.23% |

| 2005 | 3.39% |

| 2004 | 2.68% |

| 2003 | 2.27% |

| 2002 | 1.59% |

| 2001 | 2.83% |

| 2000 | 3.38% |

Type of Inflation

Let’s check out the different types of inflation that are currently existing in the economy:

Demand-pull inflation

When total demand exceeds total supply in an economy, there is an imbalance, which leads to demand-pull inflation. When demand exceeds supply, demand-pull inflation frequently causes prices for products and services to rise. This sort of inflation results from an imbalance between aggregate demand and supply, as the name would imply.

Cost-push inflation

When prices for products and services go up, this is known as cost pull inflation. People have more money to spend in the economy, which is why this occurs. What people desire to buy changes as a result. Due to the increased demand, suppliers try to maximize the value of their offerings.

Built-in inflation

This type of inflation occurs when businesses expect prices to rise in the future and build that expectation into their current prices. This can become a self-fulfilling prophecy, as higher prices lead to higher inflation

Hyperinflation

This is a very rare but dramatic increase in prices at a very high rate. It occurs when the money supply grows at an alarming rate and becomes worthless, leading to a collapse of the economy and the abandonment of the currency.

Structural Inflation

This is a type of Inflation driven by structural factors such as supply chain disruptions, bottlenecks, skill shortages, and other factors that impede the normal functioning of the economy causing persistent higher inflation rates.

Core Inflation

This is the measure of inflation that excludes certain items that are subject to price volatility such as food and energy.

What Inflation Rate is Good?

In general, economists believe that an economy benefits from having a low and steady inflation rate. However, most economists and monetary authorities aim for an inflation rate of 2% annually.

This rate of inflation is regarded as moderate because it permits certain price increases that can support economic growth without becoming a significant drag. A 2% inflation target also gives room for some flexibility in responding to economic shocks.

The optimal inflation rate, however, will depend on a variety of variables, including the state of the economy overall and where it is in the economic cycle.

For instance, a greater inflation rate may be preferred during a recession as it might encourage economic recovery. A lower inflation rate, on the other hand, would be more acceptable if an economy is overheating and exhibiting symptoms of inflationary pressures.

It’s crucial for policymakers to keep an eye on inflation and respond appropriately if it starts to go far from their objective. An economy may suffer from high or quickly rising inflation, which can have a variety of detrimental effects, including decreased investment, slower economic development, and more financial instability.

It’s also important to remember that while monetary measures like printing money to boost the economy may cause some inflation, they can also be used as a gauge of the economy’s general health.

The central bank may need to target a higher inflation rate during a recession in order to speed up the recovery of the economy, therefore aiming for 2% is a sweet spot that allows for some economic growth and flexibility to respond to unexpected events.

These considerations must be balanced, and the appropriate inflation rate may vary depending on the situation, therefore there is no clear-cut solution to the problem.

How Long Inflation Will Last?

The duration of inflation is difficult to anticipate since it is influenced by a number of variables, including monetary policy, economic conditions, and world events. Both Long-lasting inflations, as well as transitory inflation, may take place.

In general, excess demand over supply is what causes inflation. For instance, prices will likely increase if economic growth is high and there is great demand for products and services as companies look to boost their profit margins.

In this situation, inflation could persist for a long time before it slows or a fresh supply begins to flow to keep up with the escalating demand.

Inflation may be controlled by Central Banks by raising interest rates or taking other steps to slow down economic development. This can assist to minimize inflationary pressure.

However, depending on the unique conditions and how the economy is reacting to them, these measures’ efficacy and the time it takes for them to take effect will vary.

Another approach to look at inflation is as a natural process. In the medium to long term, structural factors like rising production costs, shifting demographics, or disruptions in the world’s supply chains may have a tendency to drive inflation higher.

In conclusion, it is challenging to determine with precision how long inflation will last. The overall pattern of inflation is cyclical, with periods of rising prices followed by periods of dropping prices, and this should be kept in mind.

Although it can be difficult to anticipate the length of inflation with accuracy, central banks are responsible for monitoring inflation and acting when it starts to vary considerably from their objective.

How Inflation Affects the Economy?

Who is affected by inflation? The short answer is that everyone is affected by inflation—consumers, businesses, and obviously the government. However, a party’s level of impact varies based on their particular circumstance.

Both victims and profiteers exist. Consumers with limited purchasing power who see significant price increases on necessities are losing money. Consumers who have savings experience less pain from price increases.

Debtors profit from inflation because they pay off debts with depreciated currency. Creditors receive a reduced actual value in return for their claims, putting them in the position of the victim.

The extra expenses might be passed on to customers by businesses with strong pricing power.

Companies with poor pricing power must absorb a greater portion of cost rises at the price of their earnings.

Due to “extraordinary” pricing, some oil corporations saw their profits more than double in the first half of 2022, which was the highest performance in more than a decade.

By stimulating spending and investment, inflation may promote economic growth. Consumers and companies may be more inclined to spend money now rather than later when prices are predicted to increase. This additional expenditure may result in greater economic expansion and activity.

Money loses value as prices rise because more people need it to make purchases of products and services. Lenders may increase loan interest rates as restitution in order to safeguard their own buying power. This may increase the cost of borrowing and limit economic development.

Economic instability brought on by high inflation can make it challenging for people and businesses to establish long-term planning. It becomes more challenging to forecast future expenses and profits when prices are continually fluctuating, which can make it more challenging to invest or make other crucial decisions.

Inflation versus Minimum Wage

Inflation risks to consumers go beyond spending and wealth preservation and may even have an impact on their income. Some customers attempt to boost their income in an effort to lessen the consequences of inflation. You may achieve this by putting in extra hours at work or by taking up side jobs.

Employment may suffer as a result of inflation. Companies without enough pricing power have trouble passing on the cost increases, putting their survival in peril or perhaps going out of business.

As a result, people will lose their jobs, money, and purchasing power. Real income losses are a possibility for those on fixed incomes, such as pensioners, retirees, or owners of fixed-rate bonds.

Purchasing power is harmed if pension and annuity growth rates are slower than inflation.

Price hikes and income losses combine in the worst-case scenario of stagflation, which analysts no longer forget to mention. Increased costs for the State in the form of government aid and unemployment allowance.

The cost of living may rise due to rising inflation, necessitating a raise in the minimum wage so that individuals can still afford to buy basics.

However, raising the minimum wage may also result in higher business expenses, which may eventually cause inflation. As a result, the connection between inflation and the minimum wage is complicated.