Impact of Fintech on the Financial Industry

Remember when the only way to pay a bill was by writing a check? Those days are gone, thanks to fintech.

Fintech (financial technology) is bringing massive changes the financial service industry. Fintech is employing the cutting-edge technologies these days to cause havoc in the world of traditional banking and financial services.

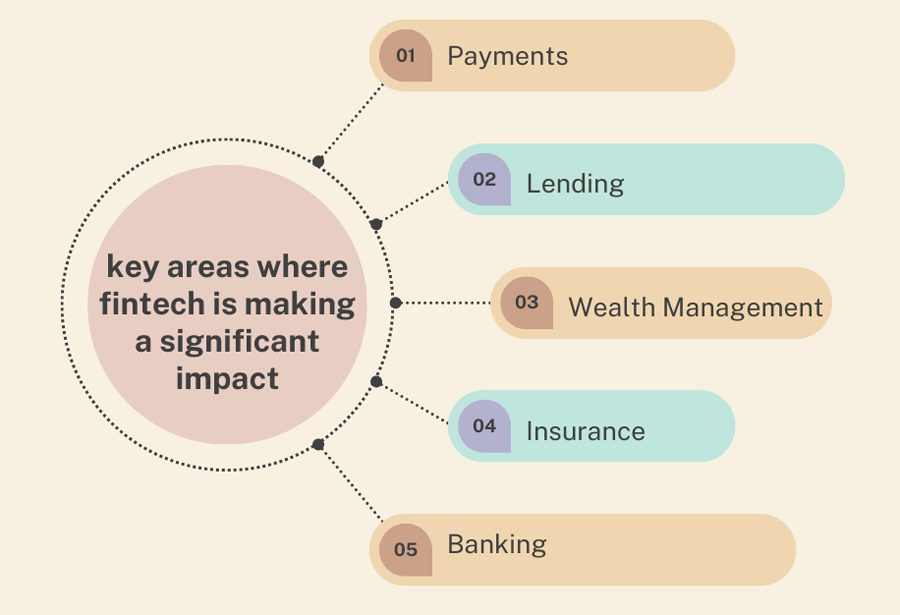

Here are just some of the areas in which fintech has a massive impact:

Payments

Mobile Payments

In these past few years, mobile payment applications by Apple, Google, and Samsung have revolutionized transaction systems. Now, consumers can buy things by just taking their phone near the payment terminal, or even by scanning a quick QR code for paying both store and online purchases. This process becomes faster and more convenient for both the consumer and the seller. For example, before, we have to wait a long time in coffee shops for payment, now we can pay through mobile devices and instead spend time at the coffee table with the drink.

Digital Wallets

PayPal, Venmo, and Cash App serve as alternatives to traditional checking accounts, especially concerning peer-to-peer payments and online transactions. It allows users to store their payment information in a secure manner and process payments without providing sensitive financial details. Think about splitting a dinner bill with friends; Venmo will easily let you send your share of the money right away without cash transaction.

Lending

Peer-to-Peer Lending

Prosper and LendingClub facilitate direct borrower-lender interaction without banks. Such platforms use complex algorithms to determine whether borrowers fit with suitable lenders who is willing to loan at below market rates. This really speeds up the lending process and often comes with better prices. For example, an entrepreneur might obtain a business loan via LendingClub faster and at a better rate than traditional banks.

Crowdfunding

Crowdfunding is a new example of the democratization of raising funds. This can be exhibited in a few cases such as: as an entrepreneur raising money for a new product, or artist raising Funds for a new creative project or getting help in case of an emergency. Crowdsourcing allows both people and institutions to raise money from thousands of individuals. A good example of this would be the hundreds of independent films emerging through the crowdsourced model of Kickstarter, where they take thousands of small pledges from backers to help fund their idea.

Wealth Management

Robo-Advisors

Automated investment platforms such as Betterment and Wealthfront use algorithms to custom-make portfolios according to the risk tolerance and financial goals of the users. The robo-advisors provide a solution that they are relatively cheaper than the conventional approach to wealth management, thus opening opportunities for a larger client base. For instance, whenever it comes to a new graduate just starting on investment, Betterment can formulate an individualized investment plan without the high fees incurred with human advisors.

Micro-Investing

With apps like Acorns and Stash, investors can invest even a small amount of money. Most of these type of apps take daily purchases to the nearest round figure amount and invest the spare change, encouraging even the smallest spender to start accumulating wealth. For instance, you pay $2.75 for a cup of coffee, but Acorns will round that up to $3.00 and invest the $0.25 for you-as if by magic, it continues to build your portfolio without breaking a sweat.

Insurance

Insurtech

Both Lemonade and Hippo are bringing a different offers to the industry – with more personalized and affordable products. Such insurtechs tend to use AI and machine learning in such a way that it encompasses everything from underwriting to claims processing. Technology does make services quicker and easier. Take filing a claim with Lemonade, for example – it could take a few minutes – instant payout for a small claim; compare that to the traditional method, which usually drags on much longer.

Digital Claims Processing

Conventional insurance companies have also been utilizing technology in sharpening their services. More of them are implementing AI-powered systems mainly for streamlining claims processing and hastening payment to clients. Just think receiving compensation for a minor car accident, thanks to AI processing a claim which do it just on a days instead of weeks.

Banking

Neobanks

Digital banks such as Chime and Varo charge fewer fees and provide better user functionality services thank traditional banks. Neobanks do not have any branches. Customers could access the bank through mobile apps and the online platform, which literally meant that it would provide continuous banking experience and even offer services like early direct deposit and no-fee overdrafts. A college student might prefer a neobank like Chime, wondering if this is a financially wise choice, since Chime charges little or no fees, and students cannot bear the fees and paperwork hassle of traditional banking systems.

Open Banking

Open banking is an emerging trend where clients agree to share their financial data with approved third-party providers in order to create brand new products and solutions. Customers are willing to provide information to obtain managerial tools for their finances, facilitate loan applications, and create services even more custom-made to their needs. For example, using an open-banking-enabled budgeting app, it is able to evaluate the user’s spending patterns to acquire better insight for smarter savings.

Benefits of Fintech

The rise of fintech has numerous benefits to both consumers and businesses:

Increased Accessibility

Fintech has closed a gap that existed in financial perceptions and made access available to many excluded by banks, especially in rural areas or poor income brackets.

Lower Costs

Fintech products are cheaper than conventional counterparts because they benefit from the efficiencies of technology.

Improved Convenience

Fintech has made it easier for everyone to manage their finances anytime, anywhere with mobile apps and online platforms without third party help.

Enhanced Innovation

Fintech is focusing on innovation in the area of financial services, creating new products and services that serve the consumer better.

Challenges and Risks

While fintech offers many advantages, it also has certain challenges and risks as well:

Security Concerns

Like all technologies, fintech has a risk of data breaches and it has a threat of cyber-attacks too. They should be paying attention to security and privacy at fintech companies to protect customers.

Regulatory Challenges

Regulatory frameworks usually lag behind the rapid advancement of the innovations in fintech, and as a result, there are always gray areas concerning compliance and the rights of consumers.

Competition with Traditional Banks

Fintech companies create competition with traditional banks and may cause unemployment and disruptions in the financial system if banks do not adapt to the changes.

Conclusion

Despite all risks and challenges, fintech is one of the fastest-growing industries in the world. As consumers seeking digital financial services more and more, new ways for innovation, accessibility, and money management tools are going to transform the industry into a completely different world.