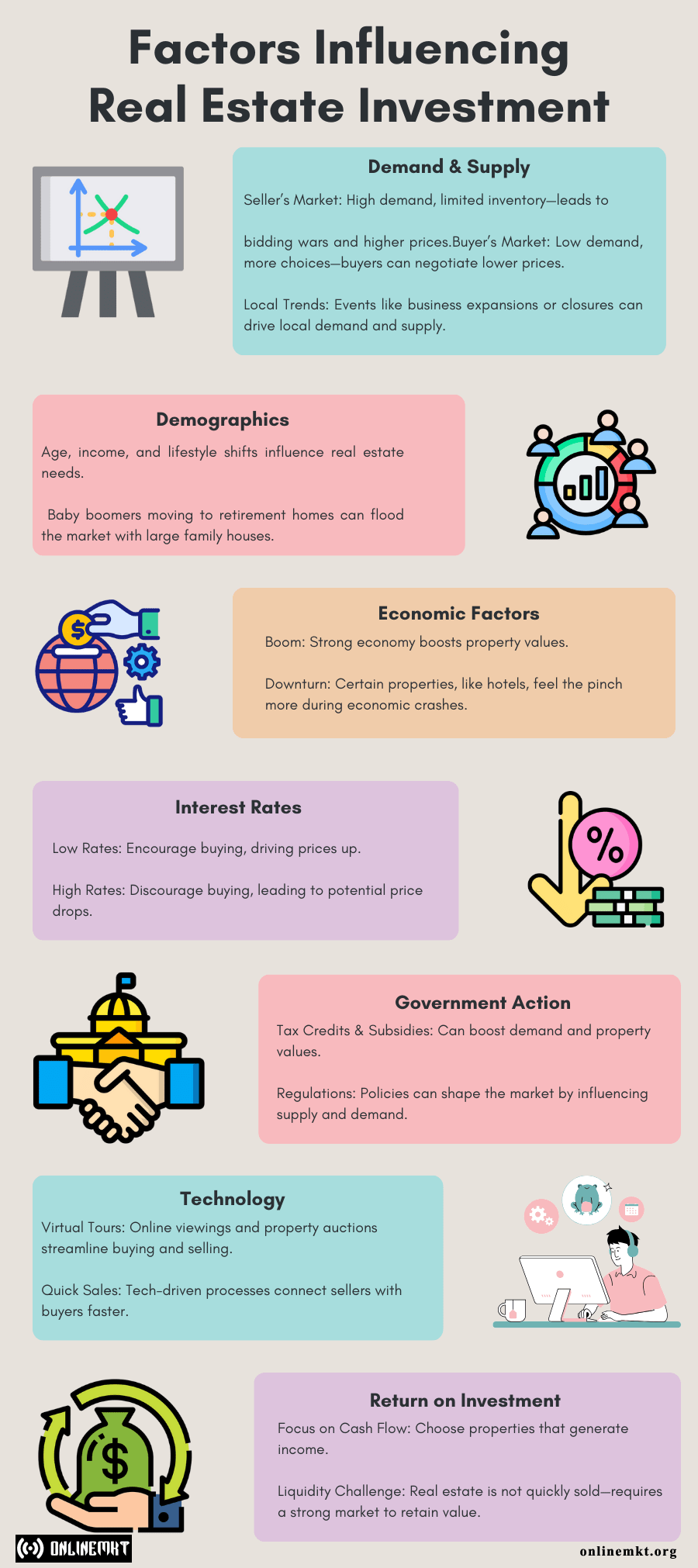

Factors Affecting Real Estate Investment

Investing in real estate has quite a few similarities with investing in other forms, where various factors determine their outcomes. Of these, rising interest rates leading to lower property values have an obvious and immediate effects; others, like changes in demographics, will gradually set property trends over time.

These influences are particularly critical during the buying and selling phases of real estate investments. When holding onto existing properties, their relevance diminishes—though there are exceptions, such as real estate-related stocks, mutual funds, or ETFs. These investments are more susceptible to stock market fluctuations and other external forces affecting the real estate sector.

Let’s find out major factors shaping real estate investments:

Demand and Supply

The market in real estate usually fluctuates with demand and supply. In the market, characterized as a seller & demand concentration, creating less inventory than the high demand will find sellers either due to this bidding war or getting an offer higher than the tagged price. On the opposite, a buyer’s market is created where demand dips and hence the bargaining power is possessed again by future buyers, who can have all options of properties and bargain better deals.

Microtrends can also affect the demand and supply locally. For example, having a big company hire thousands of employees would create a great demand for housing in that area. On the contrary, closing down of major companies may cause outflow of people living there and would thus lower demand and affect property prices.

Influence of Demographics

Demographic data like age, income, population growth, and interests rate also affects the real estate trends very strongly. Because these trends can last decades, those effects can be far-reaching.

The baby-boomers, both born between 1945 and 1964 will soon retire, and their impact on real estate market is huge. Many will displace larger family homes for space-efficient low-cost condos. So many homes may come on the market and prices could dip, another challenge for existing homeowners, but a boon for ingenious investors looking for residential options.

Economic Conditions

The economy condition turns up as one of the factor that matters most as far as real estate investments are concerned; however, this varies with property types. Property values tend to increase during economic boom periods, whereas during a sluggish economy that they actually depreciate. But all investments are not affected equally by economic fluctuations. For instance, a real estate investment trust (REIT) would suffer vigorously with much of its finances put into hotel ventures during a recession since the hotel vacation is one of the first items that are off the list of consumers’ expenditures. Office buildings, on the other hand, hold up more resiliently from economic downturns with their longer lease terms.

Interest Rates

Interest rates probably have the greatest impact on real estate markets. Lower rates tend to reduce the cost of a mortgage, which helps induce purchases and raises prices. The reverse holds true when rates rise; buyers tend to pull back, which often cools prices. However, a landlord can take the opportunity of increased rates and pass them on as increased rents to tenants.

Even REITs catch the wave of interest rate movement. Interest rates falling make REIT yields look much better which in turn propel the demand and prices, while rising rates can lower the attractiveness and value.

Government Policies

All sorts of government actions from tax incentives to subsidies can influence real estate markets. Policies such as first-time homebuyer credits usually trigger sharp upticks in demand. Understanding these dynamics can help investors anticipate shifts in conditions in the marketplace and quite simply take advantage of opportunities.

Technology

The advances in technology have changed the game in real estate transactions. Virtual tours, online property market, and even real estate auction sites are changing how people such as buyers and sellers transact business. This innovative approach makes processes less challenging and access wider in connecting buyers or sellers with the right matches.

Return on Investment

Returns maximization is the top priority of every investor. The degree of liquidity of the market, the state of the property, and its capacity for earning rental income, among others, really matter. Real estates are not as liquid as other assets; thus selling at the right time and at the right price involves careful market analysis and negotiation skills.

Conclusion

Real estate investing is affected by multiple factors, from economic trends to demographic shifts. Whether you’re buying, selling, or holding properties, understanding these elements is key to making right decisions. Success in this field can be achieved by becoming adaptable and leveraging market insights to navigate its ever-changing trends.