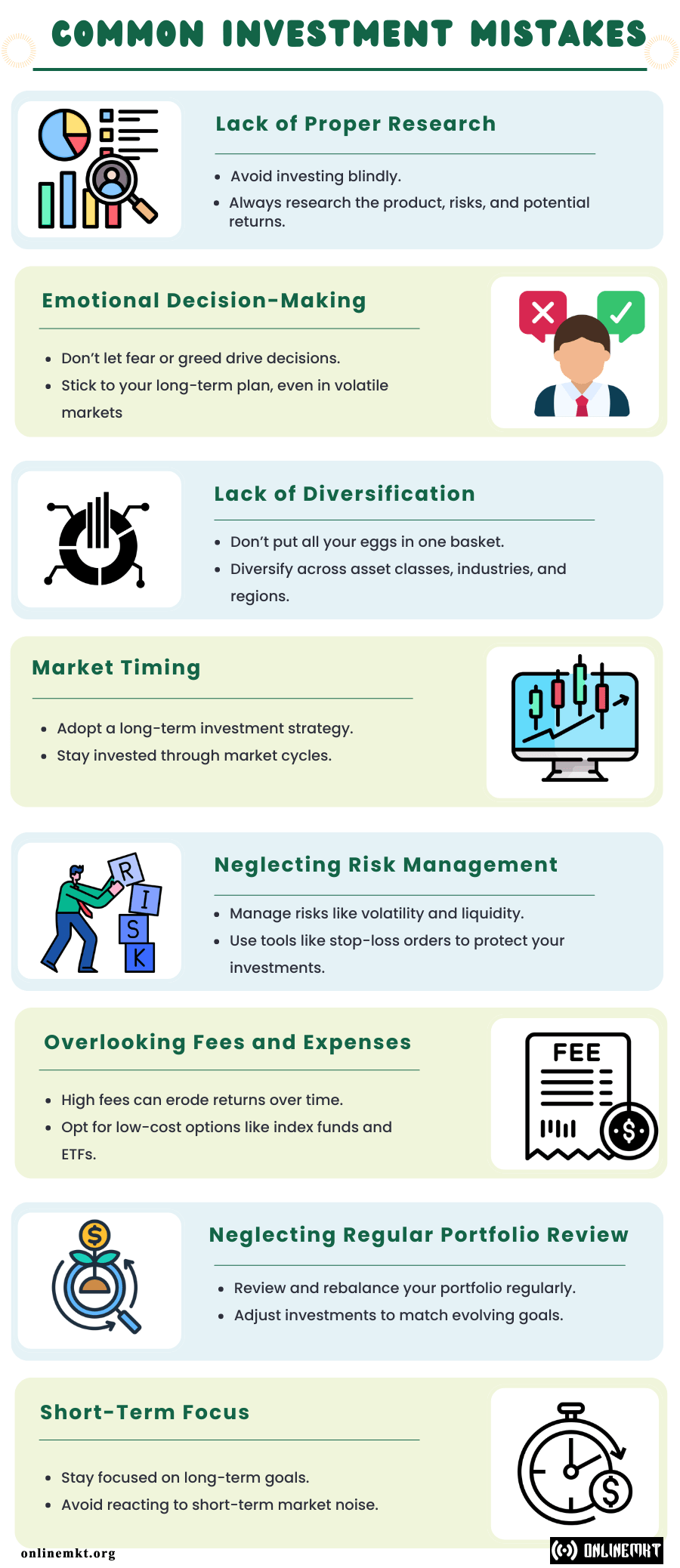

Common Investment Mistakes

Is there a secret formula to successful investing, or is it just a matter of luck?

No doubt, investment is a prominent factor of wealth generation and financial planning. However, there are certain traps into which many people fall, which affect their financial status in the society. Below are the most common investment mistakes that investors often made while investing their money.

Lack of Proper Research

Investing without proper research is one of the investment mistakes committed by many investors. Investing without understanding the product, its potential risks, and its expected returns is almost akin to sailing into unchartered waters without a map. Before investing money, do due diligence. Read prospectuses, analyze financial statements, and investigate market trends that might affect your investment. Even better, you can ask for expert advice or consult a financial advisor; their insights will help you make more correct choices.

Let’s say you consider investing in a technology start-up. You do not even bother to think about the potential investment without carrying out due diligence on the company’s financial well-being and market position in relation to future prospects. On the other hand, if you do your research, you might find that the company has liquidity issue which may indicate risk of failure for you.

Emotional Decision-Making

The effects of emotions on investment decisions are often not good. Investors are driven by a lot of fear and greed. Such an emotion may lead an individual to panic sell in a downturn period or chase after much-touted asset classes, and these usually result in massive losses. Thus, there is the need for a game plan avoidance-of-decisions process based on emotions during the volatile periods of the market. Rather, decisions must revolve around rational beliefs to minimize loss events.

Most investors panicked and sold their stocks during the crisis of 2008 suffering heavy loss. People who could manage their emotions and not sell their stakes at that time were rewarded with recovery and profits.

Lack of Diversification

A risky strategy is to put all of your eggs in one basket. If you do not diversify your investments, the entire portfolio is open to the risks associated with a single asset’s poor performance. Diversification can be done with respect to asset classes, industries, and even geographic regions, which can help spread risk and enhance the potential returns. Keeping the portfolio rebalanced regularly allows you to continue achieving the desired levels of diversification and thus keep your investments aligned with your goals.

If you put all your money into energy sectors, you will feel the pain in your entire portfolio at the time of market crash on energy sectors. Alternatively, if you had some investment in technology, health care, and consumer goods, the fall in energy may be offset, thus diminishing the impact on the portfolio.

Market Timing

With market timing – or buy low, sell high – there is probably nothing more tempting, even though it is one of the most dangerous strategy one can engage in. Short-term markets cannot be accurately predicted even by the smartest investor. Instead of constantly attempting to try to time the markets, invest in the long run. Do not sell during market fluctuations. The markets, in fact, recover over time, as historical evidence suggests. Invest over and over again, month by month in what is popularly called dollar-cost averaging, for helping to avoid the evils of market timing.

An investor would have sold all of his shares on a dip in the market expecting that it would go lower. But then he misses the ride up again when the market goes up. Staying within the market would have benefited them from such recovery.

Neglecting Risk Management

Ignoring risk can lead to severe loss. So, investors must have a comprehensive view of investment risks and need to take care of their portfolios. There are several considerations when evaluating various investments, such as volatility, liquidity, or creditworthiness. Utilizing tools such as stop loss orders or hedging strategies will definitely be at the forefront of protection from an unexpected turn in market movements.

If you are fully invested in a volatile stock, a stop-loss order sells your shares automatically if they fall below a predetermined price to minimize your losses.

Overlooking Fees and Expenses

Investment fees are small in figure, but they will certainly come back to haunt investors in terms of reduced returns over a period. Most investors think these little costs do not have any impact on their portfolio. Go through all the expenses tied to your investments, including management fees, transaction fees, and expense ratios. You can opt for low-cost solutions like index or exchange-traded funds (ETFs) that would earn you higher returns since it means low-fees, and an increase in return on investments.

Consider two funds; one of them has an annual fee of 2%, while the other has an annual fee of 0.5%. After a 20-year period, it could be found out that return out of the latter fund, with a lower management fee, would turn out to be significantly better even when both of the funds are supposed to perform similarly.

Neglecting Regular Portfolio Review

Your investment portfolio should not be such a place where you put money in and forget about it; it needs to have continuous reviews and modifications. Most probably, not reviewing or adjusting your investments can cause harm to you. With the frequent changes in the market scenario, your portfolio may not be in alignment with your financial goals anymore. Therefore, regularly assessing portfolio and rebalancing it depending on new scenarios is the ideal way to determine how best to keep your investments on the right track towards achieving intended objectives.

Initially, it might have committed yourself to 60% equity and 40% fixed income investments. Due to stock market better performance, the investor may change portfolios to 70% stocks and 30% fixed instruments-exposing even more risk to an investor. Thus, continuous adjustment on portfolio will help to achieve investors’ goal on investment.

Short-Term Focus

Short-term thinking may cause quite a substantial hindrance to your long-term financial objective. There are so many people who would lose focus on their actual investment objective and distract by short term temptations that markets offer each day. Rather, think about your long-term objectives and follow a consistent investment strategy. Being true to your plan means that you are already in a position to let you get closer to your finances.

While an investor might be tempted to sell his long-term holdings after listening to a short-term slowdown of the economy, with those who are able to maintain their long-term focus tend to be able to ride out the turbulence and benefit from the overall growth of markets.

Conclusion

It requires more than choosing the most appropriate stocks or bonds to invest wisely. Long-term financial success is achieved by avoiding common investment mistakes. Research, manage emotions, diversify, ignore market timing, be fee-conscious, review investments regularly and keep it long-term to boost the odds of hitting goals with money. Stay updated, stay disciplined, and stay the course – your future self will appreciate it.