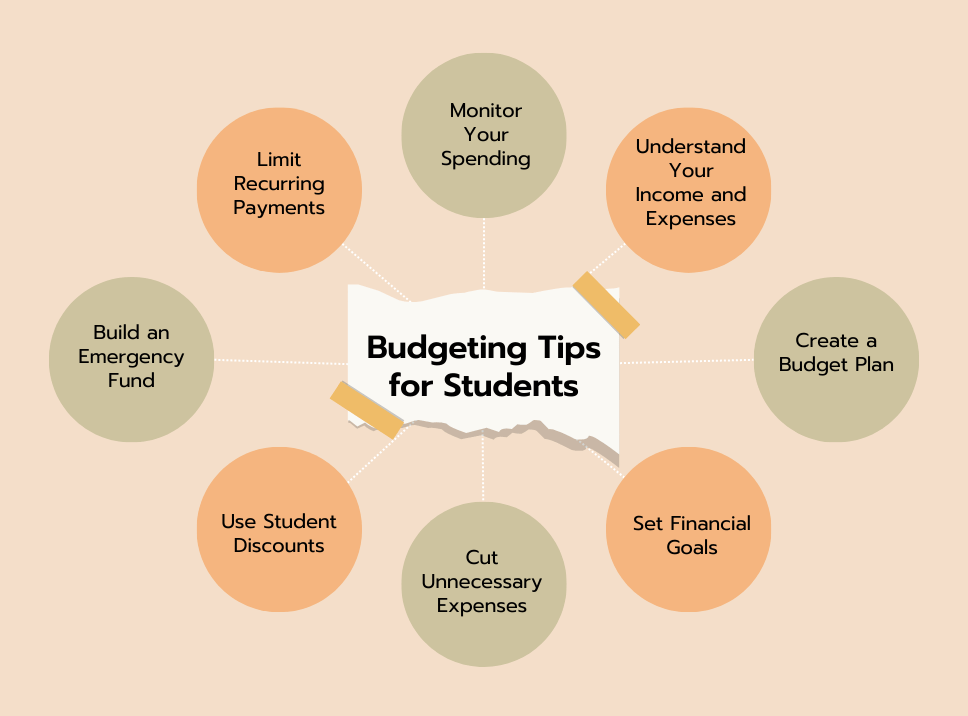

Budgeting Tips for Students

“Think budgeting is just for adults? Think again. These tips can help students manage their money like a boss.

Effective budgeting is important for students; most of them have increased the cost of living while sustaining a very small income. By spending wisely, a student will avoid unnecessary debts and reduce stress that may interfere with his or her education.

Here are some useful budgeting tips tailored for students:

Know Your Income and Expenses

Accounting for your source of income against the expenses comes first. The usual incomes that students get include aids from parents, scholarships, earnings from part-time jobs, and student loans. Expenses usually cover tuition fees, accommodation, food, transportation, and other essentials. Knowing exactly how much you earn and spend is the first step toward effective budgeting.

Create a Budget Plan

Third, after understanding your income and expense structure, make a budgeting plan. Segregate your expenses into fixed costs-rent, utilities, tuition-and variable costs-groceries, entertainment, and clothing. Then, assign specific amounts against each such head but make sure not to overspend. Budgeting apps link directly to your bank account in order to make this process simpler with real-time updates of your finances. You Need a Budget or YNAB is one such application.

Set Financial Goals

Having clear financial goals can provide motivation to stick to your budget. It may be saving for a vacation, paying off student loans, or building up an emergency fund, but achieving that goal gives your budget a purpose. Make sure your goals are specific, measurable, and achievable. As an example, try to save $1,000 during the next year for your emergency fund or try to pay $200 of credit card debt each month.

Eliminate Unwanted Expenses

Identify and eliminate unwanted expenses to free up money. Ditch the subscriptions that you hardly use. Free or low-cost entertainment, and cooking at home instead of eating out, saves much more. Instead of using a car to move around, for example, one could save a lot on fuel, maintenance, and insurance using public transportation. In addition, instead of buying a new textbook, avail yourself of the library resources.

Leverage Student Discounts

Take every opportunity to have a discount as a student where possible. Most stores, restaurants, and online services do have a discount for students. Have the habit of inquiring about any available student discount before making a purchase from any vendor. Use apps and websites listing student discounts to enhance your savings.

Create an Emergency Fund

Be prepared for any sudden expenses that may arise by putting aside some of your income. Make sure to save at least 5% every month from your earnings. This lessens the stress and brings comfort in handling unpredictable situations, like hospitalization bills or immediate travel.

Limit Recurring Payments

Recurring payments for rarely used services can be a drain on your wallet. Take some time to review your subscriptions periodically, such as streaming services or gym memberships, and cancel those you find are not needed. This way, you will earn extra cash for more valuable spending or to be held in your savings account.

Track Your Expenses

Watch your expenditure closely; this will be your gateway to keeping within your budget. Check your expenditure on a week-to-week or month-to-month basis to ensure that you are on track. Observe for any patterns where you tend to spend unnecessarily and make adjustments as may be necessary. Budgeting applications can help in giving a better picture of spending habits, making it simpler to stick to the budget.

Consider Part-Time Work

If possible, try to secure part-time work. This will clearly offer additional income but may also offer useful work experience. Consider trying to find jobs that are sympathetic towards students and/or can offer flexible hours around your study timetable: for example, working in the campus library, tutoring, and part-time retail work.

Conclusion

These budgeting tips will help students handle finances better, reduce stress, and, hopefully, enable one to pay more attention to studies. Budgeting does not imply living on a scarcity basis; rather, it deals with making conscious financial decisions that work for you, your goals, and your lifestyle. Having an understanding of your income and expenses, creating a budget plan, setting goals, cutting out unnecessary costs, and utilizing student discounts will set a great foundation for your future.