Startup Funding Options

Dreaming of turning your innovative idea into a reality? But where does the money come from? Funding is the lifeblood of a startup. The road to success with a startup is made of financial decisions.

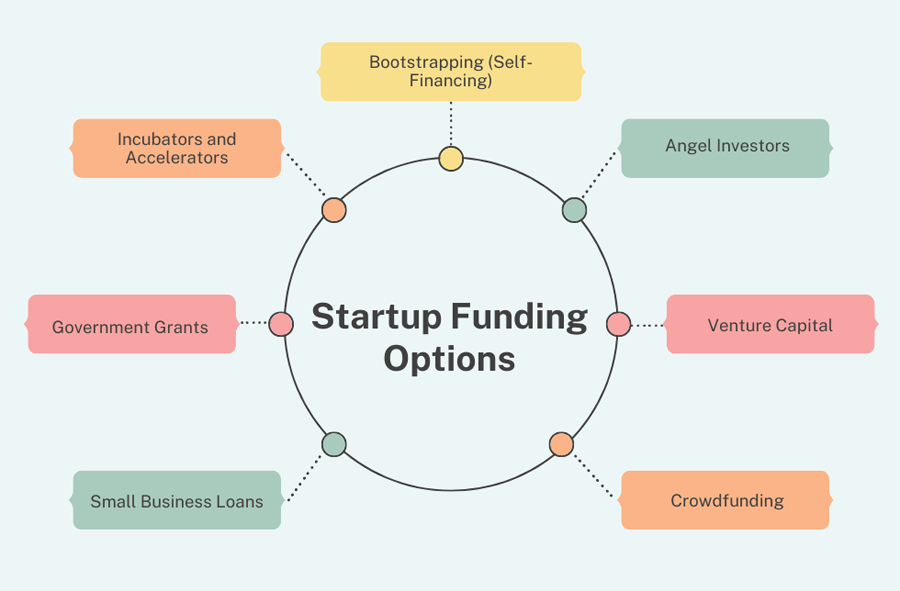

To entrepreneurs, funding is a critical step in converting innovative ideas into successful businesses. Today, various funding options exist, each with its advantages and challenges; understanding these options is critical to selecting the best avenue for your startup’s growth and success.

Types of Startup Funding Options

Bootstrapping (Self-Financing)

Bootstrapping essentially means relying on personal savings, reinvestment of profits, or financial support from family and friends to fund one’s business. This, in fact, leaves the entrepreneur in full control of their company without any debts over their head or the requirement to give away equity. On the downside, it means smaller capital, which often restricts quick scaling for the startup

Consider a technology startup that develops a kind of niche software solution. Through bootstrapping, founders can focus on refining their product without outside pressures, but often struggle to reach new markets due to a lack of financial resources.

Angel Investors

Angel investors are those high net-worth individuals who invest their money in a startup, generally in return for equity. They step in much earlier and provide not only much-needed capital but also mentorship, industry links, and strategic advice. Their investment amount could be less compared to the investments of venture capitalists, but they also play an important role in helping the startups tide over the initial stages of growth.

A healthcare startup seeking to develop an innovative medical device might attract an angel investor who has experience in the medical field. This investor can provide not only the funds needed to finalize the product but also insights into regulatory requirements and connections to potential buyers.

Venture Capital

These are representatives of venture capital firms that invest large sums of money in startups that have very high growth potential. They pool money from various investors and, in turn, expect very substantial returns. VCs generally take an active part in the business, providing guidance, strategic input, and occasionally seats on the board. While this may force a startup to scale up really quickly, it could also mean giving up some control over the decisions about one’s company.

A renewable energy start-up with scalable technology could be the one that secures venture capital to fuel its expansion. The VC firm’s involvement could help the startup navigate industry challenges and seize market opportunities, but the founders would need to be comfortable with shared decision-making.

Crowdfunding

Crowdfunding enables startups to raise capital by collecting small contributions from a large number of people, typically through online platforms. This method works well for businesses with a compelling story, a loyal customer base, or innovative products that capture the public’s imagination. However, successful crowdfunding requires a strong marketing campaign and continuous engagement with backers.

A startup launching an eco-friendly gadget might use a crowdfunding platform to pre-sell their product. The funds raised would cover production costs, and the campaign itself could serve as a marketing tool, building a community of early adopters.

Small Business Loans

Loans for small businesses, taken from banks or other financial institutions, are also good options. These require a good business plan and a decent credit history. They can offer much-needed large-scale capital, but the need to repay the loan with interest which may make borrower little bit worry, especially for startups with unpredictable revenue streams.

A food and beverage startup that has a developed business plan may be able to secure a loan to launch a brick-and-mortar location. The loan would provide the capital required, but the startup must be prepared to generate consistent cash flow in order to meet the terms for repayment.

Government Grants

Government grants are a source of non-refundable funds for innovative projects or solving social issues. The grants might considerably raise the level of finances in a startup, but in turn, are very competitive and involve exhaustive, detailed applications. A startup must demonstrate its great potential for innovation and impact.

For instance, a startup that focuses on developing sustainable agriculture technologies can seek funding from a government to sponsor environment-related innovation. This funding will be put into R&D costs to help the startup in order to launch the technology it has developed.

Incubators and Accelerators

Incubators and accelerators support startups through mentorship, resources, and sometimes funding. Incubators help the early-stage startups with space and basic support, while accelerators are for more developed companies ready to scale. Both can be very valuable in networking and gaining industry insights.

A tech start-up selected by an accelerator gets mentorship of experienced entrepreneurs, access to probable investors, and resources for quick scaling. Such a prospectus can prove highly instrumental in accelerating the growth pace of start-ups in competitive market conditions.

Choosing the Right Funding Option

Funding is a very critical choice; it can define the future of your startup. The choice depends on many factors that include the stage of your startup, the amount of capital needed, business goals, and the willingness to trade equity for investment or take debt. Below are key considerations that will help in guiding your decision-making process:

Assess Your Funding Needs

It clearly articulates how much funding is needed for your startup to reach the next important milestones. This might be for product development, marketing, hiring, or scaling up operations-whatever it might be, knowing what your needs are is very important. Be realistic in projections and make sure funding goals are in line with the business plan. Consider both short-term and long-term needs. For example: bootstrapping might cover the early expenses, however you will need venture capital for expanding your business.

Know Your Business Stage

The maturity level of your startup usually predetermines which avenue of funding is more relevant.

Ideation/Pre-Seeding stage: If you are at an initial phase and your idea is just now forming, then bootstrapping or loans from friends and family will work quite aptly. At this stage, without any proof of concept, formal investors also show emotionless behavior towards you.

Seed Stage: At this stage, you have likely developed a minimum viable product (MVP) and need funds to test the market. Angel investors or crowdfunding might be suitable, as they are typically more willing to take risks on new ideas.

Growth Stage: At this point, your startup has gained enough traction and can expand; in other words, this is the right time to take up venture capital. Venture capital can bring huge capital required for scaling but will expect an sound business model that is proven through market demand in return.

Mature Stage: At this stage, established startups with steady revenue streams may consider more traditional forms of funding, such as small business loans or even private equity, to fuel further growth or expansion into new markets.

Equity vs. Debt

One of the most important decisions is whether to give up equity or take on debt.

Equity Financing: You sell equity, and the investors come in to take shares in your company. This is mostly a good thing because the investors bring in great value in expertise, mentorship, and networks. However, you will have to share profits and perhaps some control over the business decisions.

Debt Financing: On the other hand, with a loan, there is full ownership, but it also requires the repaying of the amount borrowed along with interest. This is very good if one wants to keep control but entails careful cash flow management to be able to pay back on repayment schedules. Inability to repay may jeopardize the business.

Consider the Level of Control and Involvement

The control you want to retain over your startup will determine the type of funding you decide on.

Maintaining Control: If you want to maintain control of your business decisions, then it is best to consider bootstrapping, small business loans, or government grants. These forms of funding provide the ability to make decisions for your company’s direction without any outside influence.

Open to Guidance: If you are open to sharing control and are seeking not just capital but also strategic guidance, partnering with angel investors or venture capitalists could be the right move. They often demand a role in key decisions, but their input can accelerate growth and help navigate complex challenges.

Evaluate the Risk Tolerance

Your risk tolerance also helps to narrow down your funding options. Funding options vary in the relative amount of risk.

Low Risk: Bootstrapping and government grants tend to be lower-risk funding options because they do not require repayment or giving up equity. The drawback with these alternatives, however, may involve access to less capital.

High Risk: Both venture capital investment and angel investing are high-risk activities that typically require giving away large blocks of equity. Potential for great reward is often matched by the potential to lose control of the business decision-making process entirely.

Leverage Your Network

Your network can be a great ally in determining which avenue of funding to pursue. Mentors, industry connections, and even other entrepreneurs can give you insight into where they have been and connect you with potential investors. Networking can also help you uncover perhaps less obvious funding opportunities, such as niche grants or sector-specific investors.

Industry Specific Funding Options

Some industries have specialized funding sources specific to the unique needs of that industry.

Tech Startups: There are a lot of Venture capital which work as an accelerators and incubators that offer much more than just money for tech startups; think mentorship and resources galore.

Healthcare Startups: Healthcare startups could find funding from some focused healthcare venture funds or grants for medical innovation.

Social Enterprises: If your startup has a social impact component, there might be social venture funds or impact investors who are interested in supporting your mission.

Seek Professional Advice

The search for funding can be complex and often overwhelming to first-time entrepreneurs. Seeking advice from financial advisers, mentors, or lawyers can make things much clearer. They can also assist in making more sense of what the different options in funding can mean and structure deals that best suit your goals over the long term.

Plan for Future Funding Rounds

If you think later you will require more money, select one which will give room for a subsequent round of financing. For instance, a little seed funding from angel investors can put you well for a later venture capital round.

Test the Market

Sometimes, it is best to test the market for the right funding strategy using a small version of your product or service. Crowdfunding, pre-sales will provide initial money needed and evidence of consumer interest in your product or service idea and serve as great proof to show to investors later on.

Conclusion

Startup funding is really complex, but once the options are well understood, the founders can make fitting decisions that will serve the business goals of their startups. Each funding source offers its set of advantages and challenges; it will, therefore, depend on what your particular needs and long-term vision for your startup will be. Do thorough research and look for expert advice from financial experts to know which type of funding suits your entrepreneurial path best.