How to Build an Emergency Fund

Did you know that 70% of Americans have less than $1,000 in savings?

Emergency funds are vital as a financial safety net where one’s mind can be at peace during surprising expenses like loss of income. However, at least with a cash reserve saved earlier, you will not have to take the option of a high-interest loan or credit cards when in trouble.

How Much Should You Save?

Determining the Right Amount

Financial experts usually suggest a saving account of 3 to 6 months’ worth of living expenses as an emergency fund. It usually serves as a comfort in managing the finances in times of unforeseen events such as loss of a job, medical emergencies, or significant repairs.

Calculating Your Target

The first step is to find the right sum of cash for your emergency fund:

Track Your Expenses

Think about your costs for the past twelve months: fixed costs such as rent or a mortgage, utilities; variable costs like food and transportation.

Calculate Your Average Monthly Costs

Put all those expenses and calculate sum total. Divide by 12 that gives you the average monthly spending.

Multiply for a Buffer

Multiply that number by 3, maybe 6, and you will come up with the total amount you should be saving.

As an example, if your monthly spending on average costs $2,500, you’ll want to have an emergency fund of somewhere between $7,500 and $15,000.

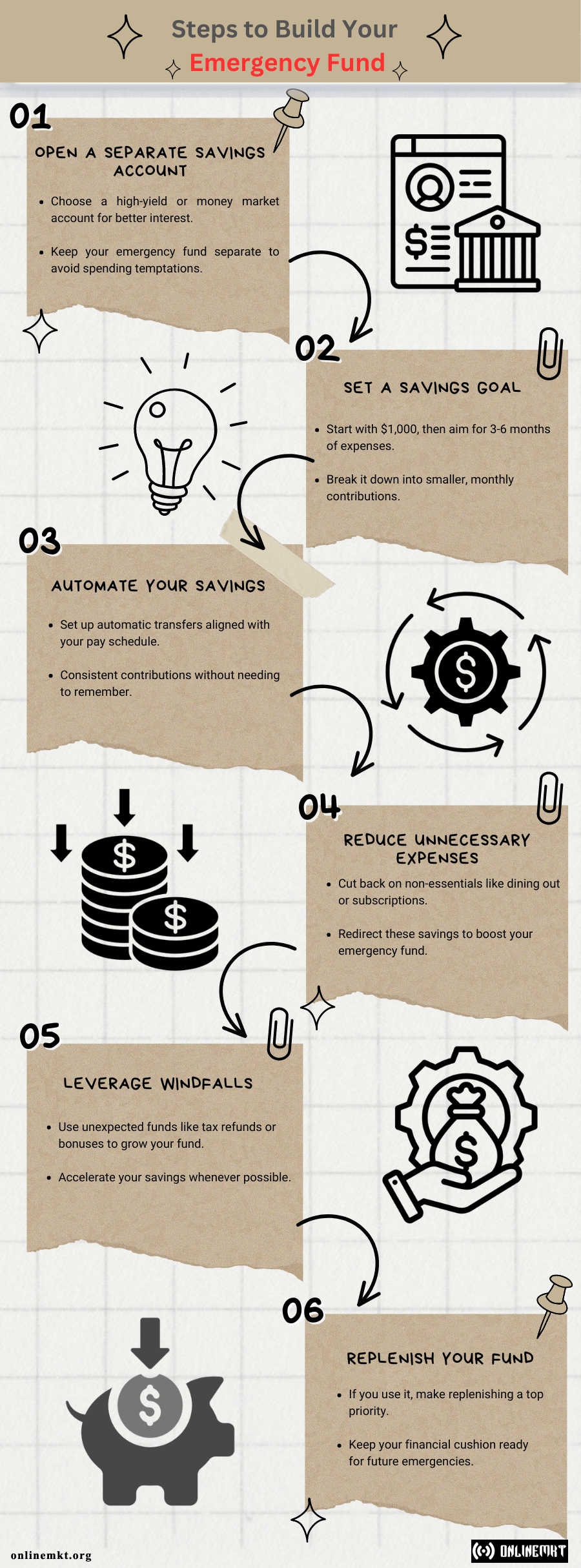

Steps to Build Your Emergency Fund

Open a Separate Savings Account

Create a savings account specifically for your emergency fund. A high-yield savings account or a money market account will allow you to earn great rates of interest while having your funds easily available. This accounts separation helps avoid the temptation of dipping into one’s funds for non-emergency spending.

Set a Savings Goal

Start with some small goal, say $1,000. Once you have accomplished that, work toward increasing it to $3,000 or $6,000, depending on your goals. Tackling your goal through smaller contributions monthly makes the goal less scary and more achievable.

Automate Your Savings

Set automatic transfers to your emergency fund from your checking account, aligning it with the pay week you receive, may it be weekly, bi-weekly, or monthly. This assures a continued contribution to your fund without the need to memorize the manual deposits.

Reduce Unnecessary Expenses

Find areas in your budget where you could cut non-essentials expenses such as eating out, entertainment, or subscription services. You could then add the savings to your emergency fund to increase the contributions without digging further into your core living expenses.

Leverage Windfalls

When you receive any kind of unexpected money, such as tax refunds, work bonuses, or gifts, consider putting that money into your emergency fund. This is a way to fill your reserve faster, using these opportunities to speed up your savings plan.

Replenish Your Fund

Due to emergency, if you ever have to make use of your emergency fund for an actual emergency, make it your priority to immediately refill the fund. In this way, your financial cushion remains for the future, for other unexpected events and emergencies.

Where to Keep Your Emergency Fund

Choosing the Right Account

An emergency fund must be maintained in an account that is separate from usual daily checking and savings accounts. Here are ideal options for emergency funds:

High-Yield Savings Accounts

These generally offer a much higher interest rate than traditional savings accounts which gives your fund the power to grow better.

Money Market Accounts

These often provide competitive interest rates and easy access to your money in need.

Ensuring Accessibility

Your emergency fund should be accessible but not quite too convenient that it would tempt you to use some, if not all, of it in nonurgent expenditures. Search for an account that eases accessibility but has relatively higher interest earnings.

When to Use Your Emergency Fund

Defining True Emergencies

Use your emergency fund exclusively for situations that are:

- Necessary: Essential expenses that you cannot avoid or defer.

- Immediate: Urgent situations that require prompt financial action.

- Unforeseen: Unexpected events that could not have been planned for.

Examples of Appropriate Use

- Job Loss: Covering living expenses while you search for a new job.

- Medical Emergencies: Paying for urgent medical care not covered by insurance.

- Major Repairs: Addressing significant home or car repairs that are essential for safety or functionality.

- Family Emergencies: Assisting with urgent family matters that require financial support.

Avoiding Misuse

Do not even think about using your emergency fund for non-essential purchases or expenses that you had already anticipated, like vacations or a new gadget. These funds must be reserved solely for emergencies, as they will interfere with their purpose and efficiency.

Conclusion

Creating an emergency fund usually requires time and discipline. Still, a critical foundation of financial freedom demands one to build an emergency fund. Set a realistic target and automate savings as you tweak your spending; little by little, it funds this. It is fund that will provide one with peace of mind and security for the family at the time of any unforeseen financial crisis.